Medieval period undercover banking method called Hawala has originated in Hindustan long before the Western-style banking system appeared. It's estimated that it operated from around the 8th century and is still used by many in the Middle East, Africa, and Asia as an alternative way to send money overseas.

Underground banking

The word "hawala" in Arabic means a parcel or a bill. But what sets hawala system apart is that all financial transactions like the transfers of money, jewelry or gold from one country to another are carried out without any documents or proof of ID - the network is built on trust of the participants in the process.

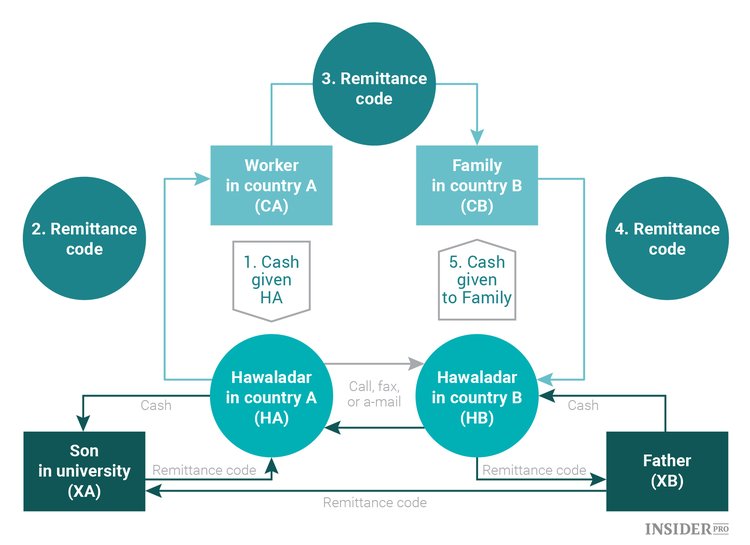

The main actors in the hawala system are the brokers of the system, called "hawaladars", they organize transfers between countries. At the same time, the money does not leave the state country. The sender gives money to the broker in one country, receives a secret code. A recipient in another country then goes to the broken in their country and tells the broker that code in order to receive the cash.

Subsequently, it’s being left to the brokers to figure it out between themselves their balance sheets either through cash, wire transfers, precious metals, or even favors.

How it works?

Here’s an example:

Suppose that a client (CA) from country A wants to pay a CB customer from country B. The hawaladar HA from country A receives the money in the currency of country A and provides a code to confirm the transaction. He then communicates via email, fax or telephone to the hawaladar from the second country (HB) and informs him of the details, and the amount that should be given in local currency to (CB). When the recipient names the code, money is given out.

This scheme is called "simple reverse hawala", the money is not physically transferred from one broker to another. Let’s assume that the sender is in U.S, and the recipient in Iran, the Iranian hawaladar will pay from his own funds. Subsequently, for the purpose of clearing accounts, the U.S.-based broker will need to process transactions for the same amount in the opposite direction.

In due time, the total net amount of transactions can be balanced out, but usually, the asymmetry of cash flows between countries does not allow it to be achieved. As sometimes capital flows mostly one way. Therefore, mutual settlements can be carried out, like bank transactions.

The method described above is not the only way the hawala system can function as brokers can engage in tripartite agreements. The hawaladars can form a network spread over several jurisdictions to balance the books through the sum of transactions between a select community of brokers.

As with the example above, brokers from the U.S. can become a debtor to the one in Iran. Let’s now presume that the Iranian broker has a client who wants to transfer money to South Africa. But if the Iranian broker does not have partners there, he may ask the hawaladar from the U.S. if anyone in South Africa owes him money. So when a hawaldar from South Africa makes a payment to the recipient on behalf of the broker in Iran, all mutual settlements are closed.

Another way to make payments through the hawala system is to use trade transactions with inflated or understated accounts. According to a report from the Financial Action Task Force on Money Laundering (FATF), agreements of this type are most common in Iran, Pakistan, Afghanistan, and Somalia. Here, brokers make payments from an active cash balance or non-cash funds as per a request of an organization, which in turn, makes payments to private recipients in the country of the destination.

Why need hawala?

Most commonly the "reverse hawala" system is used by immigrants, that left their developing countries, to send money to relatives back at home. Sometimes senders do not wish to attract attention to their transfers or may simply not have a way to use the banking system. They may reside in the country illegally or with an expired visa. In this case, hawala becomes almost the only way of sending money without the need to confirm the identity, which is required in the case of a bank transfer.

In addition to private individuals, a country can transfers funds using this method. In 2008, Financial Times analyzed how a country may bypass sanctions imposed on its banks with the help of a financial system. As journalists found out, Iran's Central Bank issued hawala brokers licenses to undertake money transfer operations, which transferred money that ended up all over the world.

Attitude of authorities

The ease with which the system can be used, as well as its non-transparency for governments and a total disregard for paperwork, make hawala an attractive tool for money laundering and tax evasion. There are also suspicions that hawala is used by terrorist organizations - U.S. special services drew attention to the system after the attacks of September 11, 2001.

Counteracting the "shadow banking" of hawala is an extremely difficult task. Some economists suggest letting the system be, but fighting against all the criminal oriented hawala. One of them is the Assistant Director at the International Monetary Fund (IMF), Mohammed El-Qorchi, in his article "The Hawala System" in 2002 stated that as long as people have reasons to use hawala, such systems will exist and grow further.