OKEx, the subsidiary of the popular Chinese cryptocurrency exchange OKCoin, became the world’s largest cryptocurrency exchange by the amount of its turnover. The crypto exchange handles more than $2 billion of cryptocurrency trades per day and has outrun its eternal rival Binance, according to Coinmarketcap.com.

Overview

OKEx is a digital asset trading platform launched by Chinese OKCoin in 2014 and has gained millions of dollars worth of investments from leading enterprises such as VenturesLab (co-founded by Tim Draper), Ceyuan Ventures, Giant Network Group, Longling Capital (founded by the Chairman of Meitu), Qianhe Capital Management, and eLong Inc.

Based in Belize, with its main operation hub located in Hong Kong, OKEx provides hundreds of token and futures trading pairs to help traders optimize their strategies. It currently serves millions of users in over 100 countries.

OKEx has ceased futures trading activity in May, transferring its users to its new futures trading exchange at OKEx.com.

This move was done so that OKCoin Intl. could “focus on becoming a regulated global fiat-blockchain asset trading platform offering spot and margin trading,” according to the press release.

OKEx is specializing in Bitcoin and Litecoin. The exchange is available on iOS, Android, Mac OS X, and Windows.

As of press time, OKEx is currently the third ranked exchange by 24 hour trading volume on Coinmarketcap, with around $1.8 billion reported in trades over the past 24 hours.

How it works

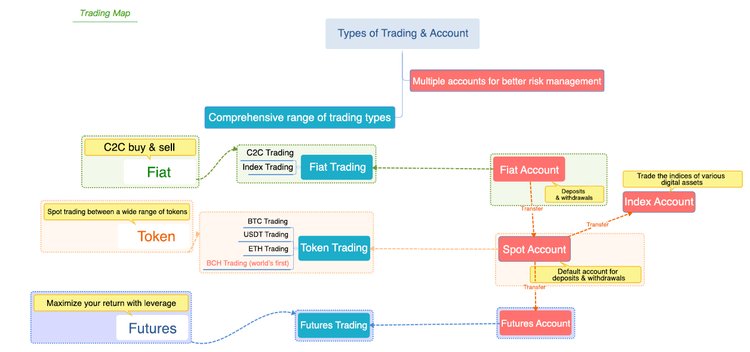

In OKEx it is possible to trade digital assets under the four outlined major trading categories: C2C, Index, Token and Futures trading. To minimize investment risks, trading funds are segregated into 4 different accounts.

The verification process on OKEX is by standard practices in the industry. There are two levels of verification on this platform. With a newly created account, the deposit and withdrawal options will be heavily restricted until the account verification is finalized. To complete the first stage of account verification, users will be required to provide the name, nationality, birth date, a copy of their government-issued ID, and proof of residence.

To complete the second level of verification, users will also have to submit a bank statement on top of the documents mentioned above. Once the second stage is complete, the daily withdrawal limit is increased to $50,000 USD for personal accounts and $500,000 USD for institutional ones.

Trading

OKEx offers to trade digital assets under the four trading ranks: C2C, Index, Token and Futures.

C2C Trading C2C trading allows users to trade between fiat currency and digital assets and users can place orders at their own prices and trade freely with all other users on the platform. The digital currency bought can be withdrawn to other accounts or wallets.

Index Trading Index Trading is designed specifically for users who want to arbitrage by buying and selling of digital assets, instead of those who want to own digital assets. Users may buy or sell anytime with designated merchants according to the OKEx indices. The digital asset bought in Index Trading cannot be withdrawn.

Token Trading A list of token pairs is available for trading. Users need to select the pair they desire to trade by scrolling down or simply type the token into the search field. There are currently 4 markets available in OKEx Token Trading: BTC, ETH, USDT and BCH markets.

Futures Trading To enable OKEx futures trading, users must fully read, understand to and agree to the "OKEx Futures Trading User Agreement". Users must agree to and comply with the agreement before using OKEx futures trading and the related services. By logging into, viewing, or releasing information about futures trading, the user agrees to abide by the terms of the agreement. Currently, eight tokens are supported - BTC, LTC, ETH, ETC, BCH, XRP, EOS, BTG.

OKB token

OKEx officially launched its native token OKB in April of 2018. Following the listing of OKB on OKEx’s platform, the exchange registered an increase in 24-hour trading volume and moved to the top spot on CoinMarketCap.com.

The total available supply of OKB token is 1 billion. 60% of the supply (600 million) will be given to OKEx users for community building through marketing campaigns. The exchange has already given away 300 million in the OKB Red Packet and Loyalty Points Subscription programs. The remaining 300 million OKB are reserved for marketing events in 2020. Through OKB, OKEx hopes to build a sharing community with blockchain technology, allowing every user to participate and contribute to the development of our platform.

OKEx officially launched its native token OKB in April of 2018. Following the listing of OKB on OKEx’s platform, the exchange registered an increase in 24-hour trading volume and moved to the top spot on CoinMarketCap.com.

The total available supply of OKB token is 1 billion. 60% of the supply (600 million) will be given to OKEx users for community building through marketing campaigns. The exchange has already given away 300 million in the OKB Red Packet and Loyalty Points Subscription programs. The remaining 300 million OKB are reserved for marketing events in 2020. Through OKB, OKEx hopes to build a sharing community with blockchain technology, allowing every user to participate and contribute to the development of our platform.

OKEx Fees

OKEx offers a volume-based maker-taker fee schedule. The trading volume is being calculated every day and the fees are being adjusted daily as well.

Token Trading - Charges -0.1% of maker fee and 0.1% of taker fee, which applies to all trading pairs.

Futures Trading - A futures settlement fee is not affected by the users tier (0.015% for BTC, 0.05% for other tokens).

No fee is charged for forced liquidation.

The withdrawal fee varies from token to token and the fee may be increased to reduce the required confirmation time.

Latest Rumors and News

China National Radio’s (CNR) “Voice of China” program has alleged that the crypto exchange OKEx is illegally working in China with Chinese clients, CNR reported on May 3. Chinese crypto exchanges have been banned from operating in the country by the government since last fall.

The Voice of China report is part of a series that aims to “reveal the secret behind digital currencies.” The article quotes reported OKEx investor Yang, who believes that OKEx still operates the company in Beijing for Chinese users. He alleges that the exchange has moved its headquarters to Belize and the team to Hong Kong in name only.

Yang says that OKEx is actually conducting crypto future transactions that use leverage to multiply trade results, even though OKEx calls them “contract transactions.” The Voice of China report also notes that OKEx has a “point to point” transaction system that lets consumers pay with their Alipay or Wechat accounts.

Voice of China adds that Yang and other OKEx investors reported the crypto exchange to the public security, industry, and commerce departments, but were told that the Financial Bureau was handling it.

By Bob Loxley