Coincheck, Japan's second largest cryptocurrency exchange, has announced that it will go public on Wednesday after merging with Thunder Bridge Capital. This makes it the second cryptocurrency platform to go public in the US.

The companies filed their final Form F-4 in May with the SEC after months of reviews. This was required for Coincheck, a foreign company, to list on a US exchange.

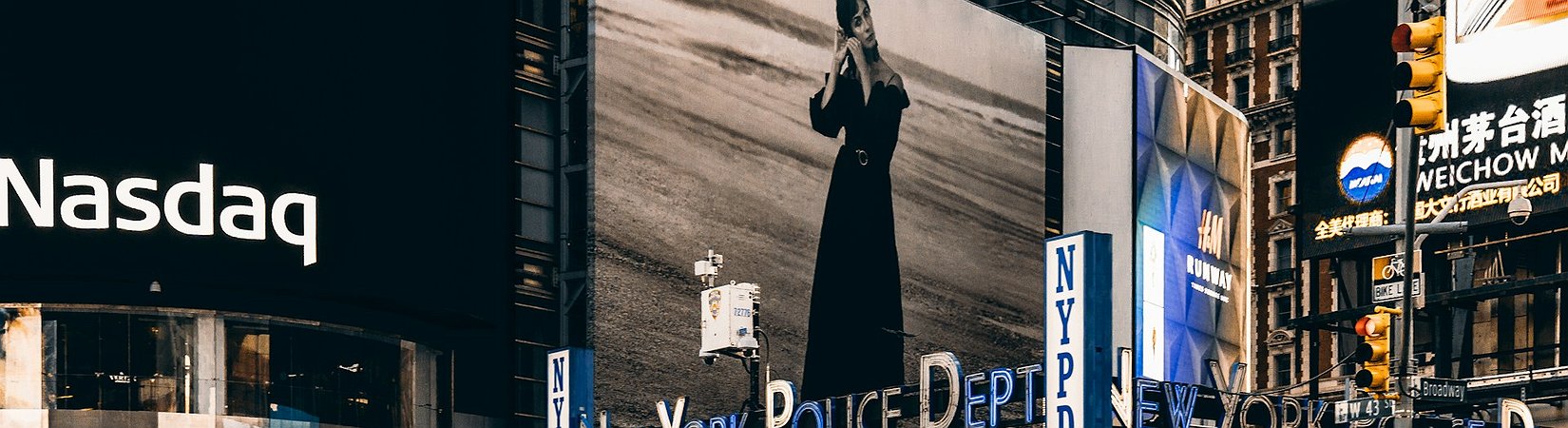

According to Coincheck, the IPO will not only provide exposure to international investors, but will also allow the company to use its Nasdaq-listed shares to hire top talent and make global acquisitions, further expanding its crypto asset business.

Monex Group chairman and Coincheck’s executive chairman, Oki Matsumoto, said:

"Coincheck was created through the fusion of a robust business foundation built in Japan, combined with the strengths of the US capital markets through the close collaboration of exceptional business and capital markets talent in both Japan and the US."