Finding the right broker is essential to be set up for success as a trader. Working with a reputable, licensed provider increases the chances of a smooth and seamless experience. Before settling on one, it’s important to thoroughly understand their product offering, account types, and fee structures.

If you’re interested in participating in the financial markets, the following review will help you to make a more informed decision about whether EXANTE is a good fit.

EXANTE’s background

EXANTE is a global investment company that provides direct market access to over 600,000 trading instruments from international markets. Servicing over 100 countries, the broker has offices worldwide and is licensed by crucial players in significant areas, namely FCA (UK), CySEC (Cyprus), MFSA (Malta) and SFC (Hong Kong). EXANTE also complies with the MiFID-II framework that regulates financial market activity within the European Union.

EXANTE's founders, Alexey Kirienko, Anatoly Knyazev, and Gatis Eglitis, launched the investment company in 2011 to democratise access to global investment opportunities for everyone. The company vision emphasises technology and transparency to help achieve this.

Now that you’re more familiar with EXANTE’s background, let’s review the specific offerings of the trading platform.

EXANTE’s offerings

EXANTE provides traders access to an impressive, growing range of financial instruments across over fifty exchanges. The broker's most notable products include Stocks and ETFs, Currencies, Metals, Futures, Options, Funds and Bonds. Let’s look a little more in-depth at each.

Stocks and ETFs

EXANTE offers over 24,000 stocks via its trading platform. Real-time pricing means people can invest in blue chips, new IPOs, and everything in between. Stock exchanges to trade from include US, European, and APAC markets, ranging from NASDAQ to the NYSE, as well as Singapore, Australia and Japan’s exchanges. Rates vary depending on the trade size and the type of stock or ETF being traded.

Currencies / FX trading

EXANTE offers 50 currency pairs with fast execution at 10-20ms. The broker affords ultra-low latency through its platform, and traders can trade forex on the spot or through swaps and forwards. Currency pairs include major ones such as the EUR/USD, AUD/USD, and GBP/USD, as well as minor pairs such as the EUR/JPY and others. Emerging currencies are also available on request. Traders can access leveraged trading, and spreads vary depending on the account type, trade size, and currency pair traded.

Metals

EXANTE offers a variety of metals for trading, including copper, gold, silver, and platinum. Traders can invest in metals on the spot or through derivatives such as futures, options, or ETFs. Precious metals are also available, with rates varying depending on trade size and metal traded.

Futures

In terms of derivatives, EXANTE offers active trading of futures. Traders have one-click access to over thirty global futures markets and over 500 futures varieties, ranging from commodities to bonds. Available markets include the US, UK, continental Europe, and APAC (at varying rates).

Options

Over 300,000 options are available on EXANTE’s platform. Investors keen on trading derivatives will find a neat option board with easy access to Greek and IV (Implied Volatility) metrics to manage and monitor markets. Exchanges cover the US, European, and APAC exchanges, including famous names such as the Chicago Board Options Exchange (CBOE), the Hong Kong Exchange, and the Chicago Mercantile Exchange.

Bonds

Last but not least, traders can also invest in bonds with EXANTE. Various choices are available, including exchange-traded and OTC bonds, and state and private bonds from governments. They have bonds offering timely interest payouts, with unlimited opportunities via the broker’s in-house Bond Screener. It allows traders to search for and invest in their bonds of choice.

Account types offered

Traders keen to sign up for an account with EXANTE have two primary options to explore: Individual or corporate.

Live accounts

Individual account holders must make an initial deposit of 10,000 EUR/GBP or the alternative currency equivalent. Corporate account holders are required to make an initial deposit of 50,000 EUR/GBP or equivalent. Traders who wish to open separate private and corporate accounts with EXANTE can do so with relative ease.

It’s worth noting that joint accounts are available for clients who want to oversee multiple individual accounts, provided they pass a compliance test and meet the requirements for personal accounts. This account type offered by EXANTE creates a whole new set of opportunities for account managers, and a maximum of four individual clients can participate in a single joint account.

Demo account

Users can also sign up for a demo account with simulated funds to practise their trading skills before committing to participating with real money. Demo account traders can trade with virtual funds of 1,000,000 EUR as a default, with the currency to be adjusted upon request. Unlike the real-time data in the live accounts, market data is delayed by at least 30 minutes in the simulated trading environment.

Restrictions on opening a trading account

As with all reputable global investment companies, a few compliance-related restrictions regarding the account holder's country of origin are in place.

EXANTE does not currently offer a service to clients from the US (citizens and residents), Japan, Iran, the Democratic People’s Republic of Korea (DPRK), Belarus and Russia. Traders from the following countries and regions also require enhanced due diligence: Afghanistan, Bosnia and Herzegovina, Ethiopia, Iraq, Lao PDR, Syria, Uganda, Vanuatu, and Yemen.

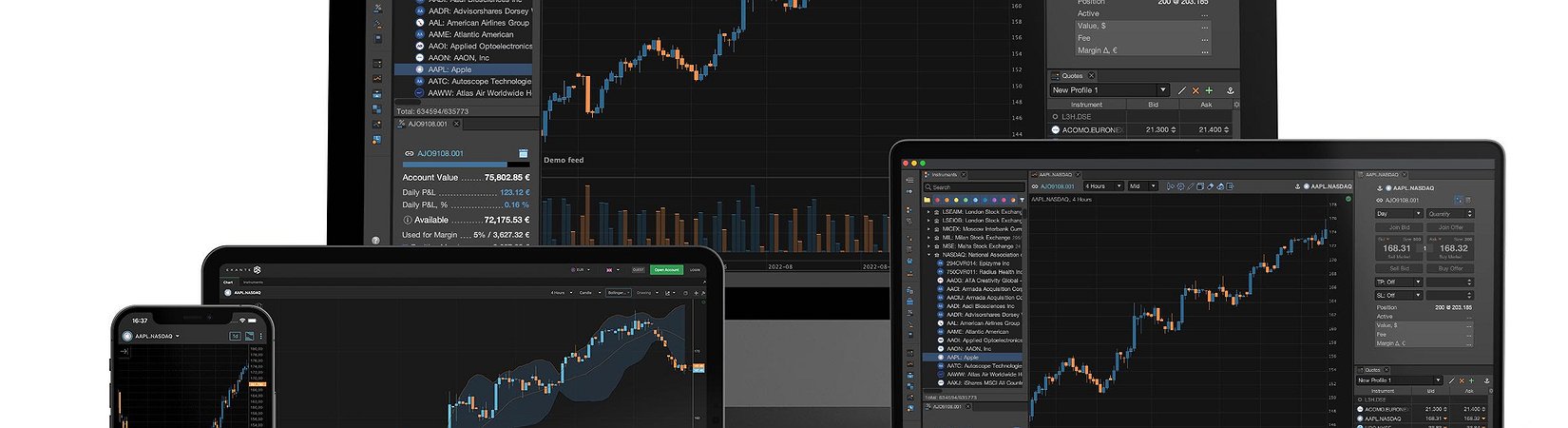

EXANTE’s trading platform

Fully remote and available on mobile and desktop, EXANTE relies on a solid network of over 1,100 servers to guarantee low latency and high security. Over and above the standard service, the platform offers real-time quotes, compliance protection and more. With a firm focus on innovating in the sector, EXANTE puts its money where its mouth is in terms of its vision to be an intuitive trading platform.

Features and functions

After first using the platform, it’s clear that the EXANTE offers a comprehensive trading experience, with full features and functions across all versions.

These include:

- Real-time account balances

- Trade activity logs

- Live market data

- Position overviews

- Current orders and historic order reviews

- Access to the Bond Screener

- Click-trade functionality

- Fast inter-account transfers

- Transaction history overviews

EXANTE can also be used on multiple devices simultaneously. Traders can run the platform on their desktops while managing orders on the trading app on their smartphones. They can even use separate directories on two opened tabs across a single device. EXANTE does caution against doing so for computers with low capacities – as it may slow down the working speed and subsequently impact trade timings.

MT4 Connection

EXANTE does not offer MT4/MT5 connections. However, more experienced traders who want to set up an HTTP connection can do so on the EXANTE trading platform.

APIs for experienced traders

Experienced professional traders can implement third-party plug-ins, such as various APIs, to execute complex trading strategies. There are two ways to do so.

Firstly, EXANTE’s HTTP API allows traders to build next-generation applications, visualise market quotes, and use options strategy advisors to improve trading efficiency. The FIX 4.4 API is also available, allowing algorithmic traders to trade automatically.

EXANTE disclaims that they are not responsible for the security and performance of third-party trading hardware that traders use – a standard issued by reputable brokers with clients who work a lot with plugins to optimise their trading experience.

Summary

In the complex world of financial markets, choosing a broker that facilitates the growth of your portfolio is essential to success.

After reviewing its features, it’s clear that EXANTE is a premium broker going beyond just regulation and compliance. Its focus on the finer details and an excellent user experience speaks for itself.

With an impressive range of financial instruments, EXANTE’s users enjoy a comprehensive and smooth trading experience, irrespective of their skill and experience level. They also have a fast-growing reputation for incredible customer service.

EXANTE is a worthy broker for traders and investors who want to participate in the financial markets with efficiency, confidence, and peace of mind.