Bankrupt bitcoin mining company Core Scientific has received a debtor-in-possession loan from investment giant BlackRock to continue to operate amid bankruptcy proceedings.

Subscribe to our Telegram channel to get daily short digests about events that shape the crypto world

According to a US Securities and Exchange filing, the New York-based investment giant has committed $17 million as part of a new $75 million loan through funds and accounts managed by its subsidiaries. Previously, BlackRock held $37.9 million of Core Scientific's secured convertible notes.

Under the agreement, the company's current equity and unsecured holders will get more shares once Core Scientific solves the bankruptcy issues.

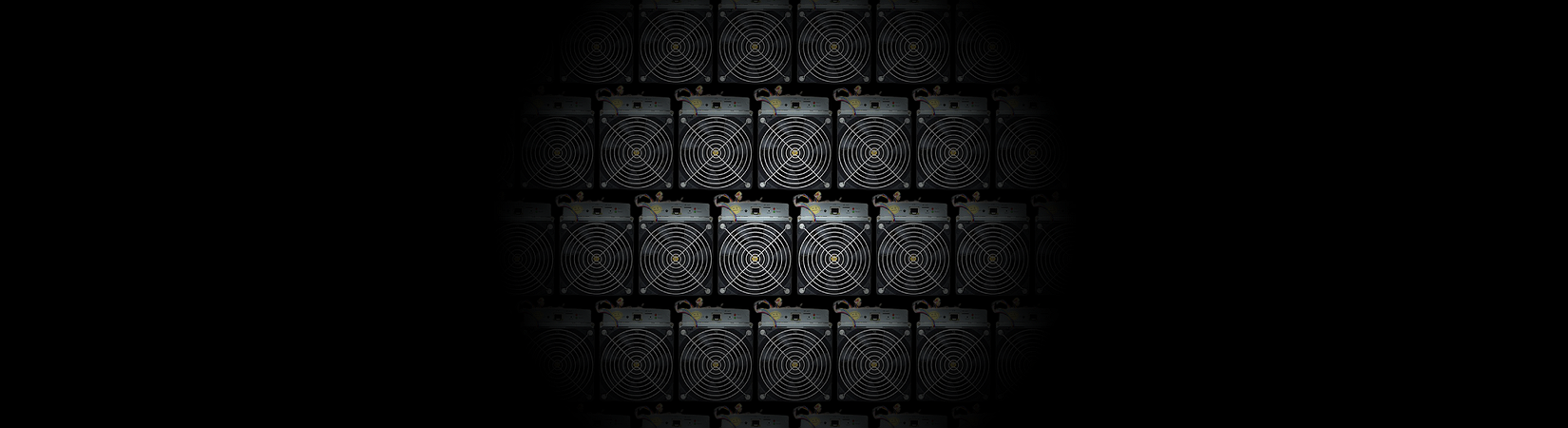

Core Scientific filed for Chapter 11 bankruptcy protection in Texas in mid-December as the company was seeking alternatives to repay its debts with creditors. Although the Texas-based bitcoin mining company is still making positive cashflow, that cash is not enough to repay the financing debt owed on equipment it was leasing.

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange