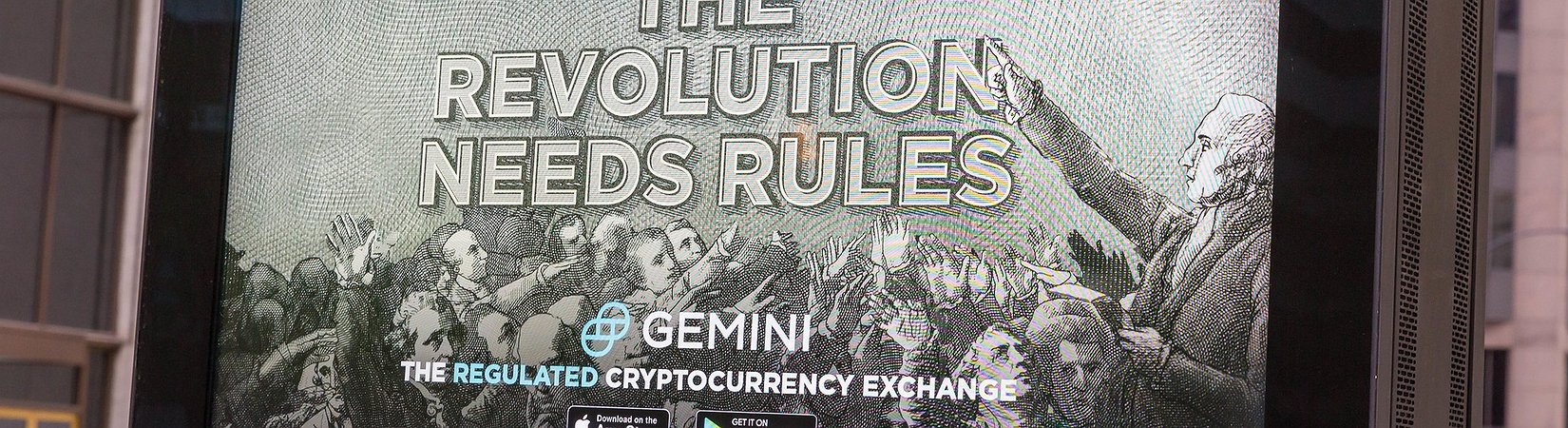

A creditor committee alongside crypto exchange Gemini has presented a plan to solve "liquidity issues" at Digital Currency Group and its crypto subsidiary Genesis.

Subscribe to our Telegram channel to get daily short digests about events that shape the crypto world

Gemini Co-Founder, Cameron Winklevoss, said in a tweet that the plan also provides a "path for the recovery of assets," without giving any details on the matter.

The Gemini boss added that the plan is based on "information received from Genesis, DCG, and their respective advisors to date." The committee expects an initial response this week, Winklevoss pointed out.

Gemini's clients have been unable to withdraw their crypto from its lending arm, Gemini Earn, since mid-November as the exchange's partner Genesis faced liquidity issues.

Gemini emphasized that the move doesn't impact its other products and services. While the New York-based cryptocurrency exchange didn't go into specifics about what caused its lending partner to face liquidity issues, reports said that Genesis interim CEO, Derar Islim, referred to FTX's bankruptcy as the reason behind the difficulties.

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange