Chainalysis, a blockchain forensic firm, has launched a new tool called "Chainalysis Storyline" made to simplify smart contract transactions, including decentralized finance (DeFi) and non-fungible tokens (NFTs).

Subscribe to our Telegram channel to get daily short digests about events that shape the crypto world

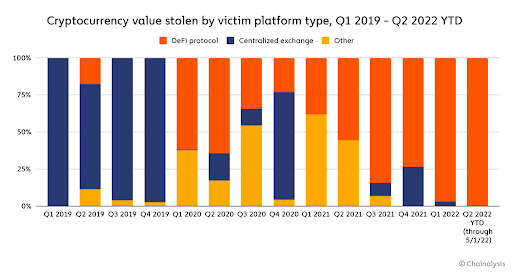

The new tool, which is currently available in a limited beta only, is expected to help crypto startups with complying anti-money laundering (AML) and know-your-customer (KYC) requirements. The New York-based firm says the DeFi market remains the top place for bad actors as DeFi smart contracts account for 97% of the $1.68 billion worth of cryptocurrency stolen in 2022.

While Chainalysis claims its tracking software dubbed "Chainalysis Reactor" can mitigate much of the chain hopping complexity, tracking funds across blockchains to separate destinations "can still be time-consuming."

"Chainalysis Storyline solves these complexities with a new, web3-native blockchain analysis tool that provides a holistic view of the movements of all funds an address has transacted with across blockchains, but still allows investigators to concentrate on the transactions and funds that matter most to them."

The new feature appears a few months after Chainalysis launched a special API that checks if an address of interest is on the sanctions list or not. Chainalysis also plans to open access to on-chain oracle developed for smart contacts that will also check if an address is on a sanctions list. The latest solution is available on several networks, including Ethereum, Avalanche and BNB Chain (former Binance Smart Chain).

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange