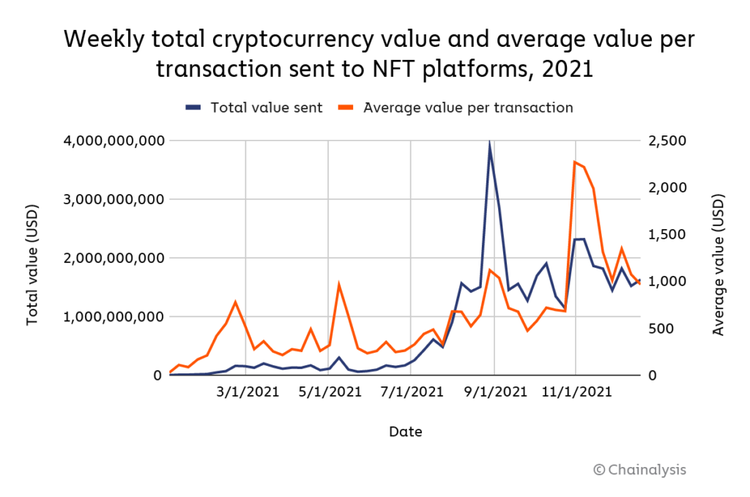

Chainalysis, a blockchain forensic firm, has said in a recent report that the market of non-fungible tokens (NFTs) is indeed a subject of "significant" wash trading that artificially increases the value of the digital collectibles. The analysts say NFTs offer potential for abuse as the technology is still in its early innings.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

Chainalysis particularly found that one of the bad actors has conducted hundreds of wash trades with NFT to manipulate pricing. For example, some made 830 sales to artificially make a look that an NFT was surging in price. In total, Chainalysis identified 262 users who sold an NFT to a self-financed address more than 25 times.

The experts estimated that over 100 profitable wash traders collectively made almost $9 million in profit from this activity, dwarfing the $416,984 in losses made by the 152 unprofitable wash traders. The calculations come after reports said the volume of transactions with NFTs exceeded $6.86 billion in January 2022. More than half (61.4%) of the indicator corresponded to the NFTs marketplace OpenSea with $4.21 billion. On January 17, the platform's trading volume surpassed $3.5 billion.

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange.