The rapid growth of the stablecoin sector brings risks to short-term securities markets, such as commercial paper, Fitch Ratings has said in a recent blog post. The international credit rating agency says these risks will depend on how the evolution of regulations will affect stablecoins.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

The New York-based company said the collateral on which these stablecoins rely can affect short-term markets, particularly as they increase in scale. For instance, Tether, the company behind the USDT stablecoin, held almost 50% of its reserves in certificates of deposit and commercial paper as of end-June 2021, Fitch emphasized.

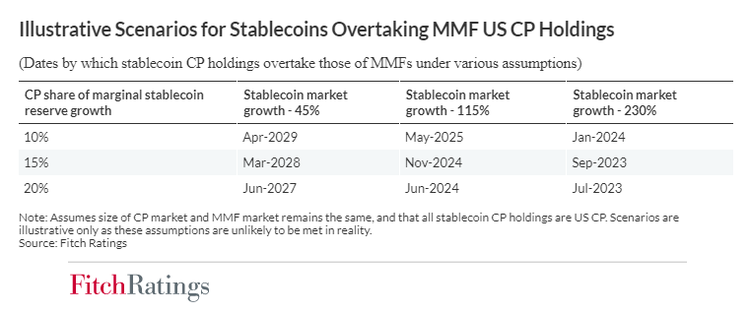

The company says the fact that stablecoins have grown to such a big scale "means these securities holdings are already relatively large." Fitch warns risks could be aggravated if the infrastructure and partners used by stablecoin operators to engage with traditional markets "lack a record in the smooth handling of transactions during periods of market stress or volatility."

The International Monetary Fund has recently also issued a warning against stablecoins saying these assets have become a "threat to the global economy." According to the latest report published by the institution, stablecoins are vulnerable to hackers, suffer from a lack of transparency in issuance and distribution as well as possible disruptions due to the high volatility of cryptocurrencies.

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange.