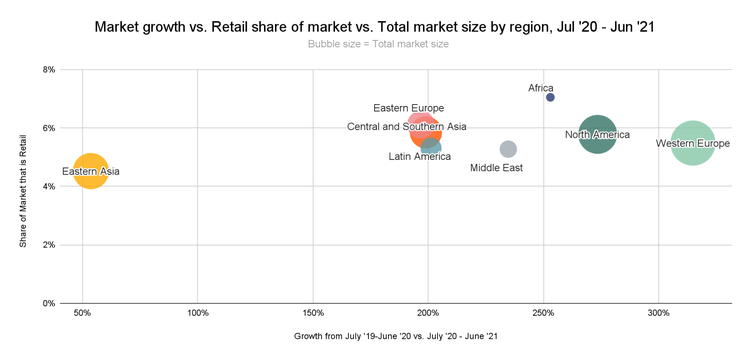

Africa is leading the cryptocurrency market as its transaction volume has grown over 1200% by value received in the last year, Chainalysis has learned. The blockchain forensic firm says Africa has a bigger share of its overall transaction volume made up of retail-sized transfers than any other region at just over 7%, versus the global average of 5.5%.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

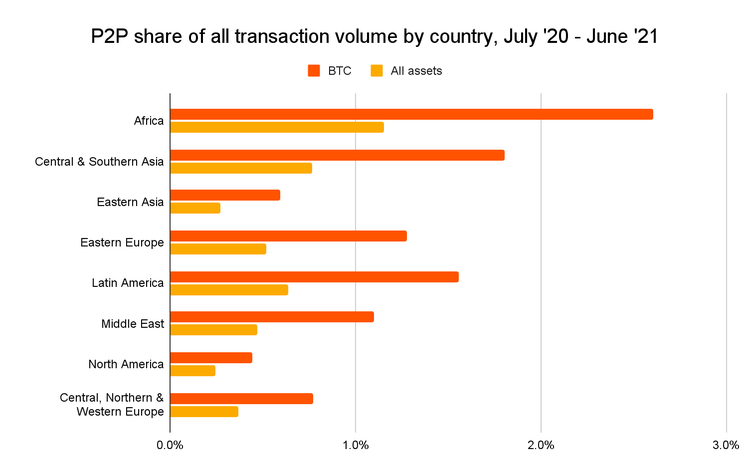

Given Africa's regulatory uncertainty, peer-to-peer (P2P) trading platforms remain the main driver of the adoption. Chainalysis counts cross-region transfers make up a large share of Africa's cryptocurrency market than any other region at 96% of all transaction volume.

In addition, in such countries as Nigeria and Kenya the majority of citizens do not have access to banking services. According to TechCrunch, there are over 40 million micro-businesses underserved in some form or another regarding banking services in Nigeria.

While the cryptocurrency market is experiencing rapid growth, several African regions are working with international partners to launch their own central bank digital currencies (CBDC). As iHodl earlier reported, the Bank for International Settlements (BIS) Innovation Hub announced plans to test international settlements with a CBDC in cooperation with four central bank of Australia, Malaysia, Singapore and South Africa. The so-called Project Dunbar aims to create prototype of a shared platform for cross-border transactions using various types of CBDCs.

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange.