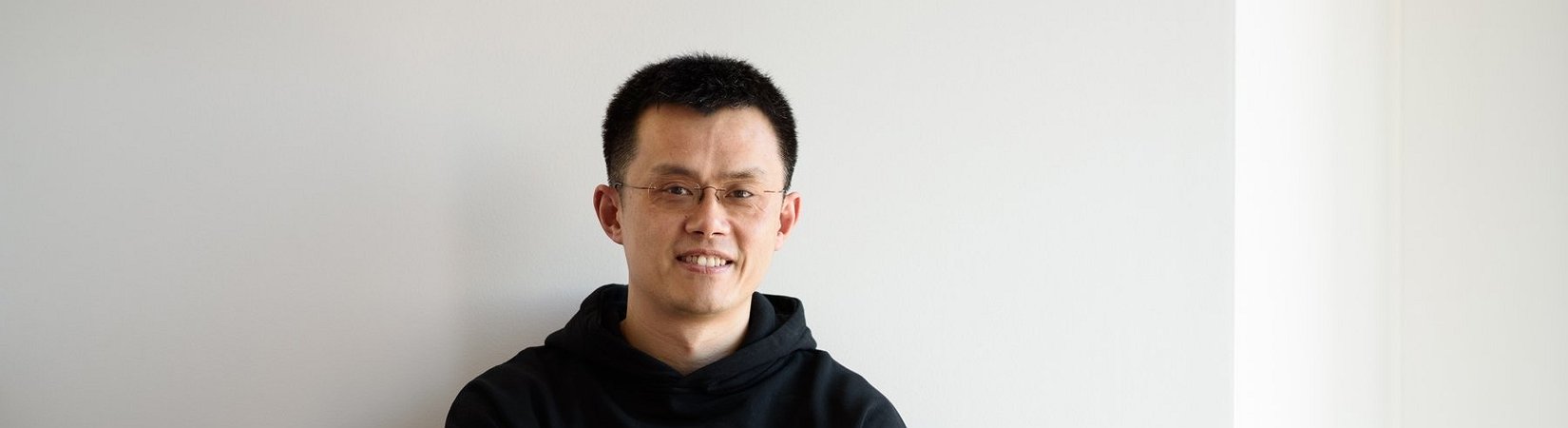

The US division of crypto exchange Binance intends to conduct an initial public offering (IPO) on the US stock market within the next three years. The company's CEO Changpeng Zhao said in an interview with The Information:

"Binance.US is just going to do what Coinbase did."

Zhao has said the unit will complete a "large private fundraising round" over the next two months. The deal will reduce the company's chief executive's control over the board of directors.

Zhao has stressed the exact timing of the placement will depend on the market and the growth of Binance.US' business:

"If the business is able to grow steadily over the next three years, then this time will be sufficient for an IPO. If we go into a bear market that goes on for, I don't know, three or four years, it may take a little longer."

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

Zhao first spoke about Binance.US' plans to go public in June. He later said the division is currently focused on developing and growing the business.

Zhao said in March the main Binance platform has no plans to conduct an IPO. According to him, the company is not in financial trouble, so it is not considering this possibility.

However, several global regulators have had their eyes on Binance's activities over the summer.