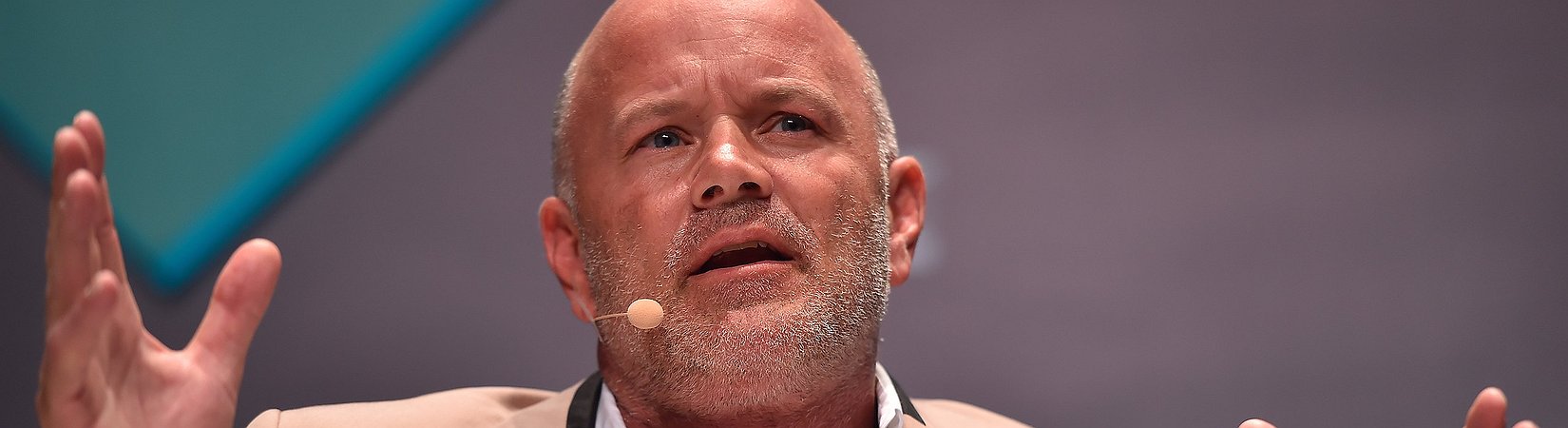

Projects from the decentralized finance (DeFi) market are more transparent and better than banks as they do not charge a fortune in fees, the well-known bitcoin (EXANTE: Bitcoin) bull Mike Novogratz wrote in a series of tweets. According to the bitcoin bull, the world would not have had the mortgage crisis if financial institutions had the transparency of DeFi protocols.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

If banks had the transparency of defi protocols, we would nott have had the mortgage crisis. Defi will win because it’s better. Atomic settlement. Bearer assets. Composability. Transparency. We just need to solve for kyc which is coming. We need to educate our politicians.

— Mike Novogratz (@novogratz) July 28, 2021

Novogratz also criticized Sen. Elizabeth Warren's pressure on the market as she recently called on Treasury Secretary, Janet Yellen, and regulators to address "growing threats" coming from the cryptocurrency market

"You really do not seem so progressive to me," said Novogratz, commenting on Warren's call for regulatory framework against cryptocurrencies.

Earlier, Elizabeth Warren urged Yellen to identify risks posed by cryptocurrencies. She also called for the creation of a "comprehensive and coordinated" framework to regulate cryptocurrencies.

As iHodl reported, Federal Reserve Chair, Jerome Powell, also called for a regulatory framework for stablecoins as this type of assets might be a "significant part" of the payments universe. Speaking at the House Financial Services Committee, Powell warned stablecoins are similar to bank deposits, however, they have no regulation.

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange.