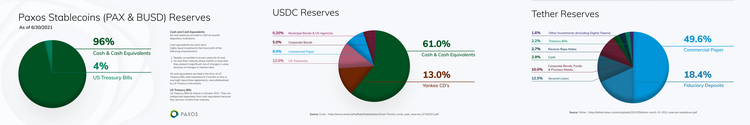

Neither USDC nor USDT is a safe stablecoin as these assets are backed by "illiquid and risky debt obligations," said Dan Burstein, Chief Compliance Officer of Paxos. In a blog post, Burstein wrote that no regulator would allow to exist such assets as their collateral creates "undue risk" for clients.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

"Neither USDC nor Tether is a regulated digital asset, for the simple reason that neither token has a regulator," he added.

The Paxos CPO claims there are only three regulated stablecoins: Paxos Standard (PAX), Binance Dollar (BUSD), and Gemini Dollar (GUSD). All the companies behind the stablecoins are regulated by the New York State Department of Financial Services, Burstein notes.

However, he admits that USDC and USDT are popular assets on the cryptocurrency market economy and have a "useful role." Burstein emphasizes that users who are willing to tolerate the risks should be free to take it.

Paxos' statements come after the company received a conditional approval from the Office of the Comptroller of the Currency for their application to charter Paxos National Trust. The company got an approval when Brian Brooks — who is currently the CEO of Binance.US — served as Acting Comptroller of the OCC.

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange.