JPMorgan Chase & Co. sees balancing buying power between retail and institutional investors for the first time over the past few years, Bloomberg reports, citing a recent data provided by the bank's analysts.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

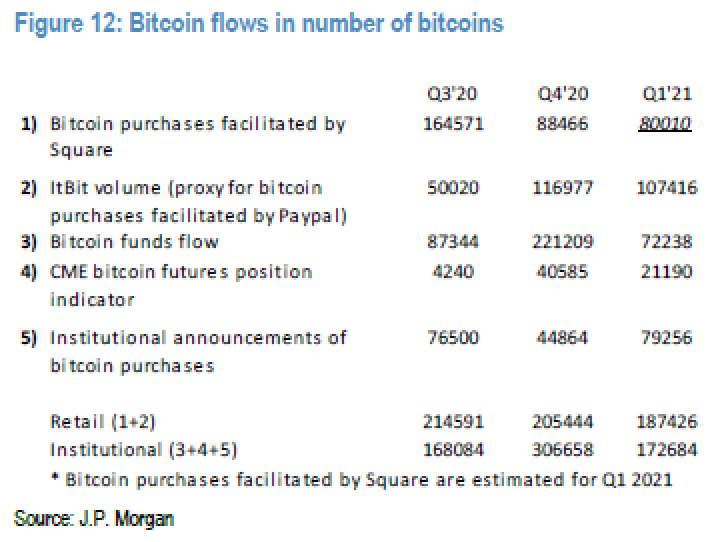

According to the bank, Square and PayPal generated a total of 187,000 BTC (EXANTE: Bitcoin) sales amid retail investors so far this quarter, compared to roughly 205,000 last quarter.

In the meantime, institutional investors have bought approximately 173,000 BTCs over that time frame after buying 307,000 in the last quarter of 2020. This means the turnover of the largest cryptocurrency by market capitalization equalizes between retail and institutional investors.

Senior market analyst at Oanda Corp, Ed Moya, says bitcoin (EXANTE: Bitcoin) was the "bread-and-butter trade" during the pandemic for the majority of retail investors.

"Meme stock trading volatility burnt many, but Bitcoin has maintained an amazingly bullish trend that has made most winners," Moya added.

Earlier, Goldman Sachs pointed out the rising demand for cryptocurrencies like bitcoin (EXANTE: Bitcoin) between its clients. According to the bank's President and Chief Operating Officer, John Waldron, the financial institution is exploring how its clients could not only invest, but also hodl the cryptocurrency.

If you are looking for a crypto trading platform to trade your assets, visit Gozo.pro, a safe and reliable exchange.