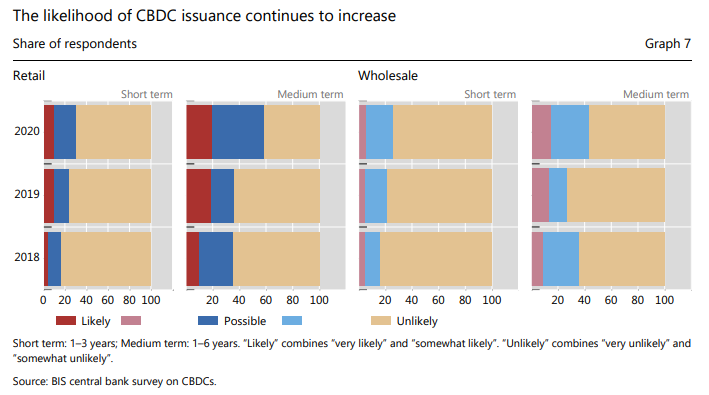

The Bank for International Settlements (BIS) estimates that central banks around the world will likely issue their own digital currencies (CBDC) in the next three years, Reuters reports.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

The financial institution says over 85% of central banks participated in its survey admitted they were exploring the benefits and drawbacks of CBDCs. Agustín Carstens, General Manager at Bank for International Settlements, says CBDCs will be an additional payment option that "coexists with private sector electronic payment systems and cash."

"In all this, the need for international coordination cannot be overstated. It is up to individual jurisdictions to decide whether they issue CBDCs or not," Carstens.

Compared to last year, the number of major banks willing to issue their own digital currency has also grown.

However, approximately a quarter of central banks still do not plan to issue a CBDC with ~48% remain unsure. About 60% believe they are unlikely to issue any type of digital currency in the near future.

As iHodl reported, the BIS in a cooperation with the Swiss National Bank and the financial infrastructure operator SIX successfully completed a joint experiment of a CBDC. The so-called Project Helvetia demonstrated "the feasibility and legal robustness" in a near-live setup. Back then, the financial institutions found that a CBDC has "potential advantages when settling digital assets."

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange.