Following its original 2016 whitepaper and successful $145 million ICO in 2017, Polkadot finally went live in 2020 and began to fulfill the vision of its founder, Gavin Wood, the former CTO of Ethereum. The smart contract network has ended the year on a high after surpassing Bitcoin Cash by market cap, placing the DOT token just behind LTC. Behind the scenes, meanwhile, development work has continued apace, as Gavin Wood revealed in his end-of-year roundup.

Built on top of the Substrate framework that powers the ecosystem, Polkadot is a sharded blockchain that connects several para-chains in a single network, allowing them to exchange data securely and process transactions in parallel. It facilitates upgrades automatically without hard forks, utilizing a governance system managed by DOT native token holders.

So let’s take a look back at some of the main events from Polkadot’s breakout year and its prospects for 2021.

Polkadot’s Initial Release and Launch Roadmap

2020 marked the end of three years of development that had to survive the loss of $98 million in ether funds frozen in the Parity wallet bug. The Web3 Foundation continued to support its flagship project, alongside two more private token sales, culminating in the Polkadot Proof of Authority (PoA) launch that went live in May. It built on the success of its experimental Kusama test network alpha release in 2019, a proving ground for Polkadot’s technology and functionality.

During the initial PoA phase, the governance process was managed by the Web3 Foundation while validators began joining the network and signaled their intention to participate in consensus. Phase 2 Nominated Proof of Stake (NPoS) then launched in June once the network grew a large enough decentralized set of validators.

Phase 2 also enabled the Polkadot governance modules: a Council, a Technical Committee and Public Referenda to take over the chain’s decisions. Governance had now transitioned into the hands of DOT token holders and was no longer under the control of a centralized entity.

The first act of governance was to make a public proposal for an upgrade that lifted the restriction on balance transfers that were previously only possible via OTC exchanges and IOUs. The proposed upgrade was enabled in August, finally allowing the listing of DOT. Top tier exchanges like Kraken and Binance supported the token from the outset, followed by Ledger hardware wallet support via the Polkawallet app and Metamask browser wallet integration.

Polkadot is now moving into the next stage of core capability development, including para-chain auctions, para-threads, and cross-chain message passing. It will then become a fully functional Relay Chain, the central chain of Polkadot that provides security through NPoS and coordinates the system as a whole, including para-chains.

2021 will also see continued research for further scalability on Polkadot 2.0, the features of which will be up to the token holders.

Redenomination of DOT

Following a successful community vote, DOT also redenominated in August. One old DOT became equal to 100 new DOT as the token supply increased from 10 million to 1 billion, adjusting the number of token holdings but not the overall value.

The token redenomination had something of a stock-split psychological effect, coinciding with a meteoric market cap rise in a matter of weeks, as DOT went from outside the top 100 cryptocurrency rankings to reach the top 10.

The phenomenal performance was at least partly down to the redenomination, with some investors perceiving it as more affordable, alongside the network launch, transferability, DOT listings and other factors.

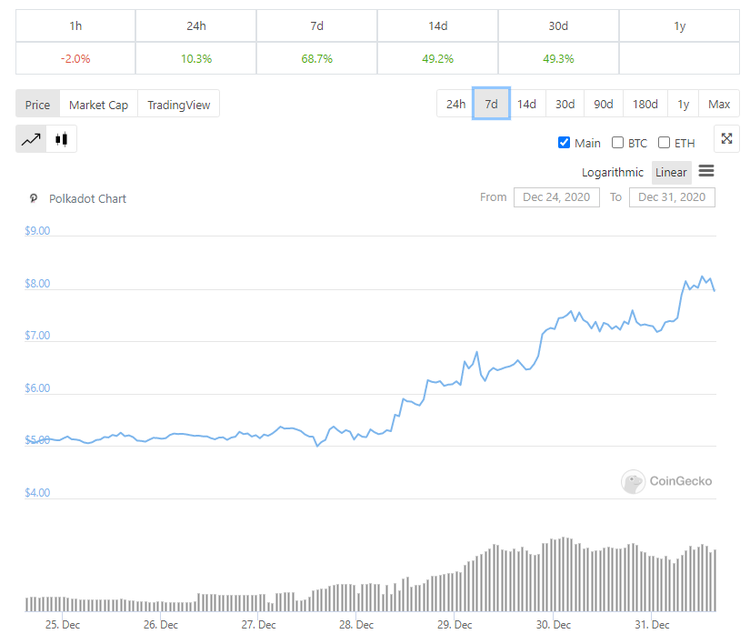

DOT has since gone on to cement itself in the top 10, with a market cap of over $6 billion. The latest 40% increase came in the space of just one week following Binance’s announcement of a $10 million fund to support projects on Polkadot and providing the platform a lot more exposure on its homepage.

Projects Begin Building on the Polkadot Network

Polkadot has attracted many projects from the outset as portrayed by the "Young and Investing" YouTube channel just a couple of days ago, with examples including Acala’s cross-chain stablecoin platform; Moonbeam’s smart contract para-chain that allows developers to use their existing Ethereum applications on Polkadot; Chainlink’s oracle technology being brought to Polkadot users, Polkastarter’s decentralized exchange platform; Plasm, a layer-2 dApp scaling platform for Substrate-based chains, Laminar’s open finance platform powering synthetic assets and Darwinia’s protocol for cross-chain bridges.

The August launch of the Rococo testnet brought in more interest, allowing projects to test their para-chain functionality before deploying on to Polkadot itself.

This traction has continued throughout the year, with an impressive 325 projects now building out smart contracts, oracles, NFTs, DAOs, bridges, data, privacy, gaming, IoT and DEX solutions on Polkadot.

Polkadot’s Expanding DeFi Ecosystem and Prospects for 2021

The rise of decentralized finance has helped fuel the growth of the Polkadot ecosystem in 2020 and presents some of the most exciting prospects for it over the coming year. While Ethereum dominates the current DeFi space, savvy investors are hedging their bets on other blockchains that could grab market share in 2021, with Polkadot a frontrunner given its cross-chain compatibility.

Polkadot can build on the success of integrating DeFi projects like Chainlink and SushiSwap, as it allows independent blockchains to be developed or infrastructure to be deployed on top of existing para-chains. The resulting composability opens up a range of interesting use cases we can expect to see in 2021:

- Insurance platforms

- Yield aggregators

- DEX aggregators

- Derivatives

- Decentralized futures

- Permissionless options trading

- Credit risk protocols for lending and borrowing

- Fixed interest rate loans

DeFi built on Ethereum and Bitcoin will be able to interoperate with the Polkadot ecosystem using bridges. For example, Chainsafe and Snowfork are working on Ethereum bridges, while Interlay is building a Bitcoin bridge that will see Bitcoin coming to Polkadot in Q1 2021.

Interlay will introduce Polkadot’s first trustless wrapped bitcoin. Once deployed, users will be able to mint 1:1 Bitcoin-backed assets onto Polkadot, as PolkaBTC, and could find use across a wide range of applications, including decentralized exchanges, stablecoins and lending protocols.

‘A Bet Against Blockchain Maximalism’

Gavin Wood doesn’t buy into the narrative that there should only be one blockchain, nor that Polkadot is some sort of "Ethereum killer," commenting in a recent interview that Polkadot is essentially a "bet against blockchain maximalism."

Instead, Polkadot represents a blockchain era of scalability, interoperability and security, not built-out as one of a series of independent protocols, but as a network of networks to bridge the existing infrastructure, ignite new use cases and become a core hub of decentralized finance in the year ahead.

As Wood concludes in his 2020 review, "the first few months of 2021 is looking to be a very exciting time... with para-chains, slot lease auctions, crowdloans, bridges, XCMP-lite, XCM and Cumulus set to land, not to mention the 50-or-so para-chain teams which will be vying for their slot to launch."

Speaking of bets, you wouldn’t want to bet against Polkadot breaking new records in 2021 – and flippening LTC along the way.