Institutional's interest in the cryptocurrency market is driven by a desire to hedge against macroeconomic uncertainty, Chainalysis, a blockchain analysis company, believes. In a new report, the analytical firm claims the current crypto rally is different from the 2017 bull run in who is buying bitcoin (EXANTE: Bitcoin) and why.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

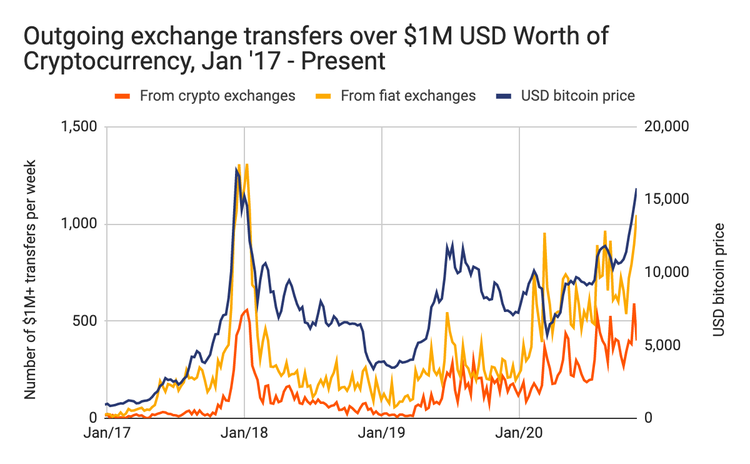

Chainalysis determines 2020 as the year institutional money began flowing into the Bitcoin space. In particular, the firm shows there is a significant increase in high value transfers sent from cryptocurrency exchanges in 2020.

The blockchain-focused company estimates that in 2020 crypto exchanges have sent approximately 19% more transfers worth $1 million or more while BTC has been over $10,000 as compared to 2017.

"That suggests that the individuals behind these transfers have more money to spend, as we would expect when bigger investors get involved," the company points out.

Chainalysis says the current bitcoin surge contains advantages not only as for prices' increase itself, but also as for why they are rising. This time investors have become savvier and more strategic, the company highlights.

In October 2020, Chainalysis stressed that financial institutions should individually assess each cryptocurrency exchange with which their customers transact to manage risks properly.

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange.