Compound Finance's fork called Percent Finance has accidentally frozen almost $1 million of users' funds due to an error in a smart contract. The platform's developers say users' cryptocurrencies are stuck in money market smart contracts. The funds (USDC, WBTC, and ETH) are reportedly frozen due to an error in the interest rate model update.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

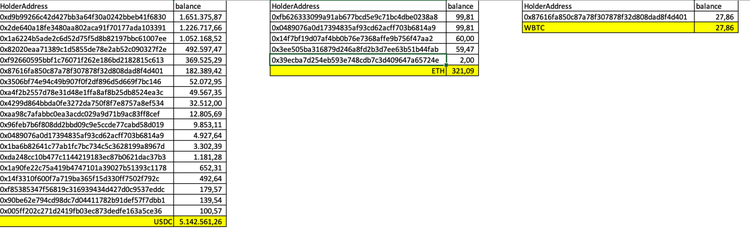

Users cannot supply, borrow, repay or withdraw from these cryptocurrencies. According to an official blog post, the amount locked is 446,000 USDC, 28 WBTC and 313 ETH and approximately 50% of which belongs to community mod team wallets.

"Other money markets are currently operational. Please repay any outstanding loans and withdraw. Please do not borrow in any markets," the developers said.

The team behind the project has already said it is going to reach out to Circle, Coinbase and BitGo to help release those funds. However, the locked ETH may be irretrievable, the developers claim.

As iHodl reported earlier, hackers managed to steal approximately $371,000 from the users of the DeFi project Opyn by exploiting a vulnerability in the oTokens, the project's internal token.

The developers of the protocol confirmed the vulnerability that allowed hackers to steal ETH Put contracts, but assured that the rest of the contracts had not been affected by the attack.

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange.