Grayscale Investments has announced it recorded the largest ever quarterly inflows with over $1 billion in the third quarter of 2020.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

According to an official press release, the year-to-date investment into the Grayscale products surged above $2.4 billion, with cumulative investment across the Grayscale products now totals $3.6 billion.

In the third quarter, Grayscale Bitcoin Trust also saw a multi-million increase with $719.3 million of inflow recorded. Grayscale’s assets under management also reached all-time highs during the third quarter. For example, Grayscale’s AUM increased from $2.0 billion up to $5.9 billion (approx. +195%).

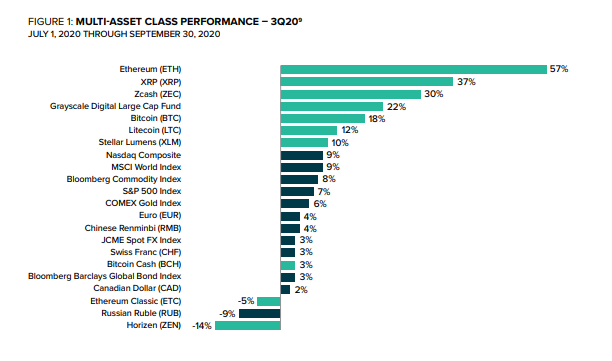

The company says an average weekly investment was $80.5 million as bitcoin (EXANTE: Bitcoin) remains the most popular asset. Grayscale explains such growth in demand can be explained in investors' interest in cryptocurrencies as they "have outperformed major indices YTD."

In September, iHodl reported that Grayscale Investments controlled 2.4% of the total bitcoin supply after investing $180 million in the crypto last through its Bitcoin Trust.

While Grayscale's investment is remarkable, there are other companies that also believe in the potential of the largest by market cap cryptocurrency. For example, MicroStrategy up to date accumulated approximately 40,000 BTC since its first purchase of BTC in August. At press time, BTC is trading at $11,339 (-0.39% per 24h).

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange.