An analytical blockchain firm, Chainalysis, has issued a new report in which clarified on how Latin America mitigates economic turbulence with cryptocurrency.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

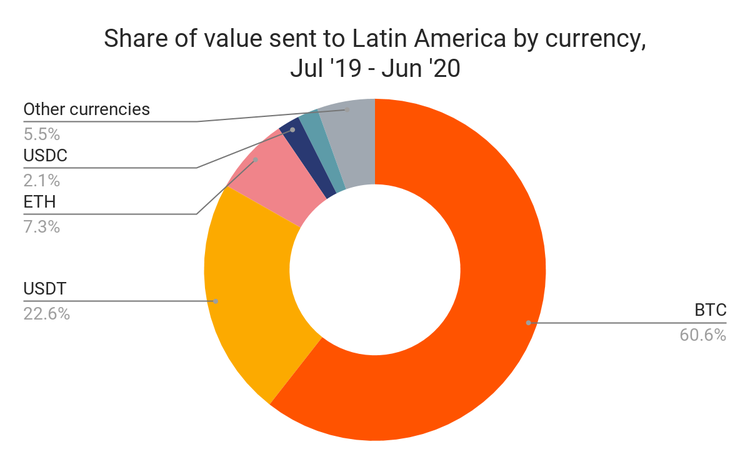

The firm states crypto adoption in Latin America is triggered by several factors, including bank's limitations, currency instability and commercial transactions for goods between Asia-based exporters and Latin American businesses.

Today, many people in Latin America are unable to get bank accounts, which in turn, makes them turn to crypto.

Head of Operations at SatoshiTango, Sebastian Villanueva, says lots of people here have uneven income because they do gig work for Uber or places like that, which makes it hard for them to get a bank account.

"Without easy banking access, many young people in Latin America turn to cryptocurrency as a means of storing value," Villanueva added.

Chainalysis claims currency instability is also a key factor for cryptocurrency adoption. While Venezuela and Argentina are actively printing money, their fiat currencies are losing in value.

The adoption is especially active in countries, like Argentina, that limit the amount of US dollars citizens can buy per month. This makes people consider cryptocurrencies as a safe way to store money, and there are no gatekeepers in crypto, Villanueva added.

Earlier Chainalysis figured out that Venezuela's crypto transaction activity is allegedly driven "by people connected to the Maduro regime seeking to launder funds or move them out of Venezuela."

Venezuela is known as one of the most active countries in terms of p2p crypto volume. Currently, the country ranks third place in p2p trading volume in USD, after the US and Russia.

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange.