Popular cryptocurrency deposit and savings platform POKKET has just announced plans to bring cryptocurrency options to the masses, by launching call and put options for more than 50 different altcoins. The platform now plans to extend its offering, by launching savings products for 15 new tokens between the 17th and 21st of August.

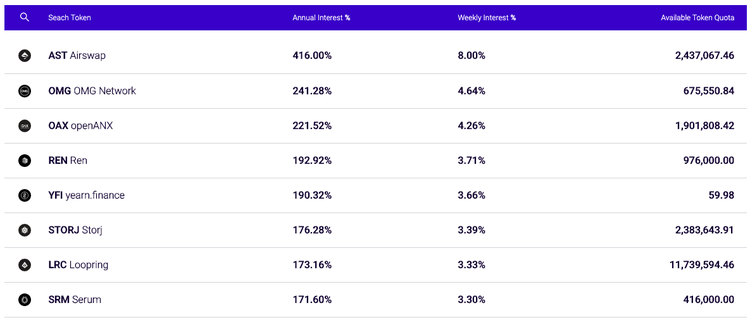

Unlike standard cryptocurrency options trading platforms like Deribit and Binance, POKKET will be launching these options as simplified structure savings products, which users hold for one week and earn a return while doing so. As of writing, these savings products offer between 2.6% and 416% APR, but this fluctuates daily since it is based on the market conditions of the chosen cryptocurrency.

Although POKKET’s structured savings products take all the difficulty out of turning a reasonable return on cryptocurrency deposits, the technology that makes this happen is what allows the platform to offer the impressive yields it does. In brief, POKKET users are actually sellers of put options, which are a type of financial derivative that tracks the underlying price action of a cryptocurrency. POKKET’s team connects these users (put option sellers) with institutional buyers behind the scenes, and distributes the option premium they pay as interest to users.

So far, the platform has received more than $4.4 million worth of user deposits — $3 million of which were made in the last four months, as investors look to capitalize on the increased market volatility and earn as much as 8% interest in a week. As it stands, POKKET currently offers an estimated 2.67% weekly yield for Chainlink (LINK), 2.76% for Aave (LEND), and 0.63% for Ethereum (ETH). This is equivalent to 127.4%, 131.6%, and 30.7% APR respectively.

To put this into perspective, even the most generous fiat savings accounts typically offer a yearly APR of just 1-3%, while most corporate and government bonds are around the 1% mark — both are eclipsed by the returns offered by POKKET. POKKET users can now choose to gain their interest in more than 50 different altcoins, or in two different stablecoins — Tether (UDST) and TrueUSD (TUSD).

The way it works is simple. If the market price of the underlying token asset selected by the user is above 91% of its initial price, then the user receives their initial investment back, plus their interest paid back in their chosen stablecoin. Whereas if the selected token is equal to or down more than 9% compared to the initial price after one week, then the customer receives their interest, and gets the underlying token at a 9% discount.

All assets deposited to the platform are protected by POKKET's cold storage security solution, and the firm overcollateralizes all user deposits by a further 10% to protect them against market fluctuations.