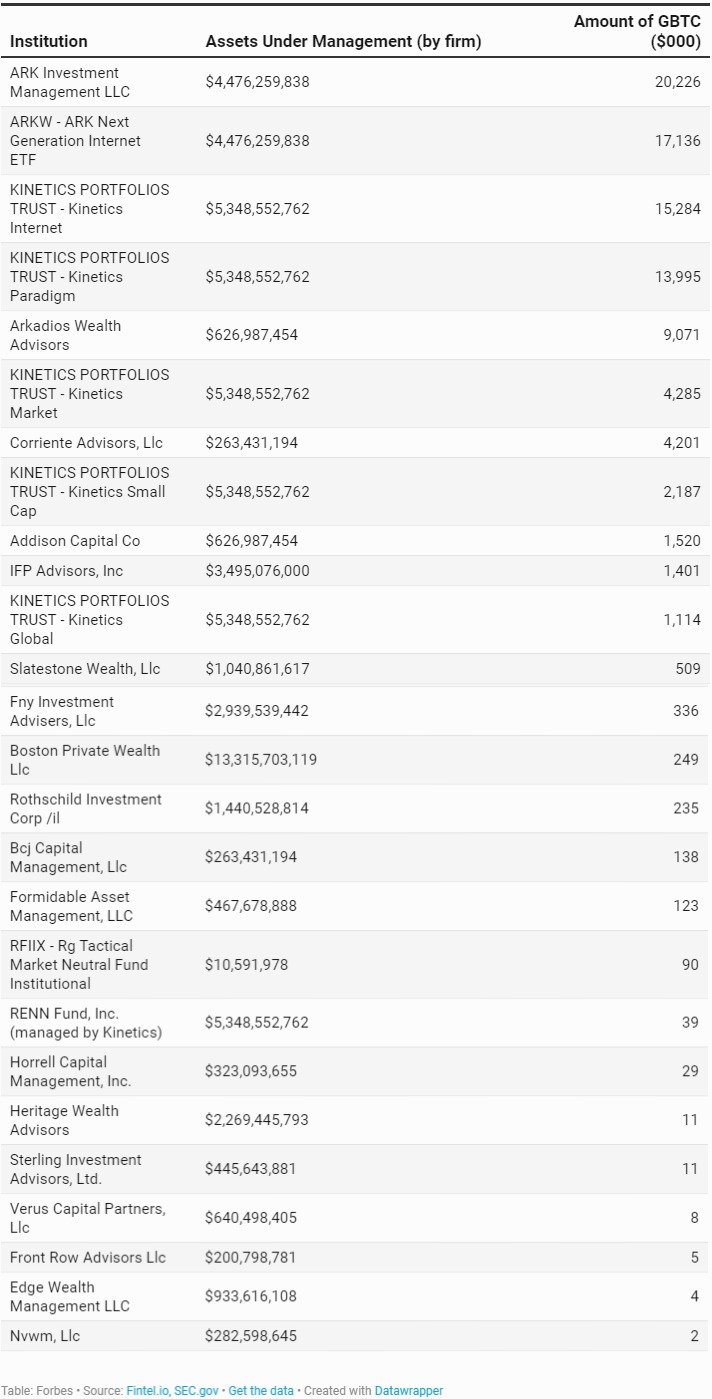

During the last quarter, 20 institutional investors have filed reports with the US Securities and Exchange Commission. According to the documents, these investors have invested in the Grayscale Bitcoin Trust (GBTC), Forbes has reported.

The list includes major members such as Ark Invest, which has $4.5B in assets under management, and Horizon Kinetics, which manages $5.3B. In addition, there are also some newcomers such as Addison Capital and Corriente Advisor. Ark Invest crypto analyst Yassine Elmandjra said:

"It's very difficult to have a clean one-to-one signal on who's entering and exiting the space. But there are some very interesting proxies that can gauge institutional interest."

This source of data could soon be limited if the SEC eventually approves its plan to increase the minimum requirement for companies to submit such reports from the current $100M to $3.5B. These nine funds are mined by only 3 companies, meaning that much of the diversity of the space, the smaller institutional investors who are starting to experiment with the new asset, would disappear.

Grayscale Ethereum Trust yesterday filed to become an SEC-reporting company.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.