The US Federal Reserve has sharply reduced the interest rate, lowering the base interest rate down to 1-1.25%, lowering it by 0.5% (previously it was 1.5-1.75%). This reduction is the biggest decline since the 2008 financial crisis.

The American financial government explained the reason for an emergency interest rate cut was due to the spread of coronavirus infection COVID-19, which imposes additional risks for economic activity.

"We saw a risk to the outlook of the economy and we chose to act," said Fed Chair Jerome H. Powell.

Fed leaders voted unanimously to lower the rate, and Powell tried to express a sense of calm during a short 13-minute press conference. He has repeatedly said that the U.S. economic situation still looks healthy, but admitted that "sentiment" has changed.

Erik Nayman Managing Partner, Head of the Wealth Management Division at Capital Times says the urgent cut in is a potent medicine. If it does not help, then the patient (the American economy) is really seriously ill and there is an even more difficult period of the disease ahead, Nayman added.

Alexey Kirienko, the Chief Executive Officer of an online brokerage company EXANTE, believes that the effort is not enough.

Just reducing the rate is not enough if the factories are closed, the supply chains are broken — all this happens regardless of the Fed rate, Kirienko said.

"Reducing the rate is dangerous because the closer the rate is to zero, the fewer instruments the Fed remains with, and when the economy appears to be in a situation not of a hypothetical but of a real crisis, there will be nowhere to reduce it," he added.

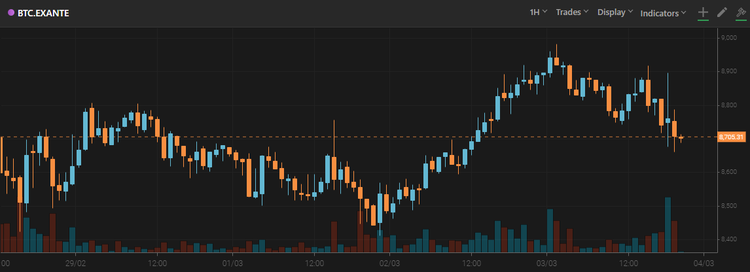

Chart of the USD/BTC trading pair from EXANTE

At the time of writing, bitcoin (EXANTE: Bitcoin) almost did not respond to the Fed's actions and is traded at the $8705 mark.

Earlier iHodl reported that the financial watchdog the German Federal Financial Supervisory Authority (also known as BaFin) issued guidance in which clarified the status of digital assets.

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.