J.P. Morgan analyst Nikolaos Panigirtzoglou suggests the downside risk for bitcoin (EXANTE: Bitcoin) still remains even though there is high anticipation among market participants amid CME bitcoin options launch, Bloomberg reports citing Panigirtzoglou's report.

Panigirtzoglou confirms, there has been "a step increase in the activity of the underlying CME futures contract" over the past few days. The J.P. Morgan analyst is convinced the unusually strong activity reflects "the high anticipation among market participants of the option contract."

However, according to Panigirtzoglou, bitcoin’s value is still below the market price following a significant divergence in the middle of last year.

"The market price has declined by nearly 40% from its peak while the intrinsic value has risen by around 10%. The gap has not yet fully closed, suggesting some downside risk remains," the analyst added.

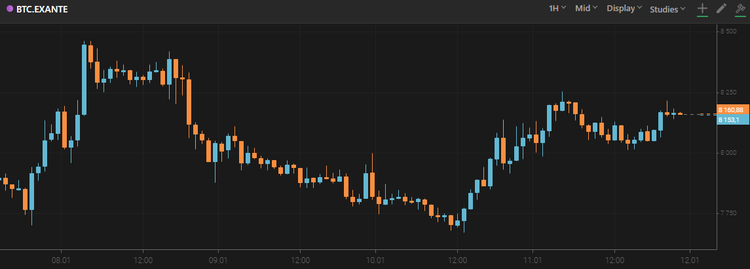

Over the past 24 hours, bitcoin's price managed to rise up to $8463, break down to $7742 and grew once again up to $8160.

Chart of the USD/BTC trading pair from EXANTE

Earlier iHodl reported that according to a study carried out by analysis service Glassnode, crypto exchanges store about 10% of all bitcoins in circulation.

Access more than 50 of the world's financial markets directly from your EXANTE account – including NASDAQ, London Stock Exchange and Tokyo Stock Exchange.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.