One of the largest cryptocurrency-focused asset managers, Grayscale Investments, within the #DropGold campaign has revealed a survey from Blockchain Capital according to which millennials are much more likely to buy, hold, and use bitcoin (BTC) than any other demographic cohort.

This survey of over 2,000 adults was conducted online within the United States by Harris Poll on behalf of Blockchain Capital from October 18-20, 2017 among 2,112 U.S. adults, ages 18 and older.

Moreover, according to the survey, 27% of millennials think bitcoin is more trustworthy than big banks (e.g. Wells Fargo, JPMorgan, Goldman Sachs).

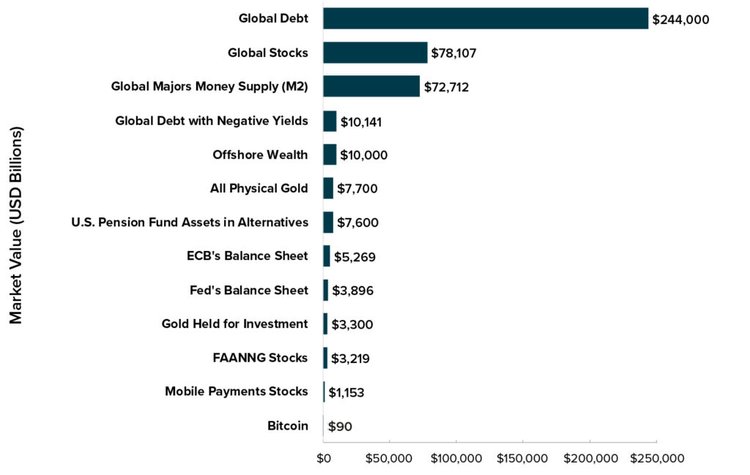

In addition to that, Grayscale highlights that bitcoin is still in its infancy since bitcoin's value nowadays "is only a tiny fraction of the markets it stands to disrupt, which reach well into the trillions of dollars."

The investment company assumes that bitcoin will be one of the "uncorrelated assets" into which large funds of generational wealth will flock down.

"With an estimated $68 trillion in generational wealth changing hands over the next 25 years (including $48 trillion from Boomers), we may see more investment dollars make their way into uncorrelated assets like bitcoin," states the survey provided by Grayscale Investments.

Last year, the annual Grayscale's inflow had reached over $300 million.

Over the course of three quarters, the company earned $330 million, which is more than in all previous years. Over the same period, Grayscale earned only $25 million in 2017 and $17 million in 2016.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.