The Chinese mining company Bitmain announced the launch of Bitmain Crypto Index, which will help investors monitor status of the digital asset market. The index will track a number of the largest and most liquid cryptocurrencies in the company's opinion and be expressed in the U.S. dollars.

“The Index is solely owned by Bitmaintech Pte. Ltd. and is administered by Bitmain Index Operating Committee (‘BIOC’) which will conduct regular review and engagement with external stakeholders for feedbacks to keep the Index methodology as updated and representative as possible,” Bitmain said in a methodology overview.

The index will be presented in two versions — in the form of a spot rate, published every second, and as a calculated rate, published once a day at 10 a.m. Hong Kong time.

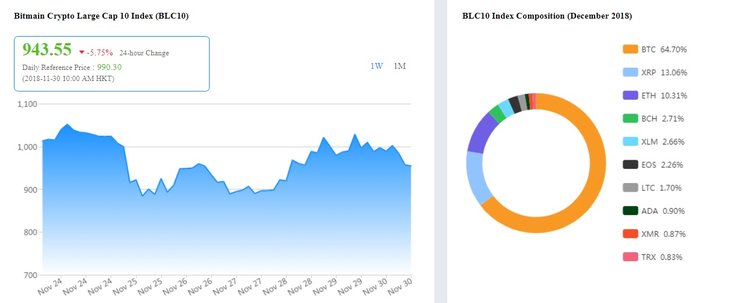

It will represent costs of 17 cryptocurrencies with the highest market capitalization. The service will also provide a combined index called Bitmain Big 10 (BLC10), which is formed on the basis of 10 cryptocurrencies with the highest capitalization. The digital assets included in it generate 90% of the total market share, according to Bitmain.

The index uses data from Bitfinex, Binance, Bitstamp, Bittrex, GDAX, Gemini, Huobi, Itbit, Kraken, OKEX, and Poloniex. Subsequently, the list of exchanges that provide information may be changed. Every month, the company's committee will review the service technology.

Bitmain explains that the new tool is designed to provide institutional and individual investors with an objective guideline. Earlier this month, the largest OTC platforms for cryptocurrency trading, Cumberland, Genesis Trading, and Circle Trade, announced that they will jointly develop a new bitcoin index called MVIS Bitcoin US OTC Spot Index.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.