Revolut Ltd is a digital banking alternative. Launched by ex-finance professionals in July 2015, it seeks to enable customers to easily manage and move around money in multi-currencies.

Revolut allows to send fast and free money transfers to bank accounts in over 140 countries at the real exchange rate. By enabling free international money transfers, feeless global spending and by providing access to the cryptocurrency exchange, Revolut aims to break down the borders of banking.

Revolut Founders and investors

The London-based startup was founded by Nikolay Storonsky and Vlad Yatsenko.

A former trader with Credit Suisse and Lehman Brothers, Revolut CEO Nikolay Storonsky experienced astronomical fees that are applied to foreign exchange transactions and has now “reinvented the way we spent and transferred abroad.”

Prior to co-founding Revolut, Vlad Yatsenko spent ten years building financial systems at tier one investment banks. He has been at the forefront of Revolut’s next-generation technology.

Revolut is backed by some of Europe’s most well-known investors, who have invested in companies like Facebook, Dropbox and Skype.

Cryptocurrencies and fiat currencies supported

Revolut provides an “easy and fast way to buy, hold and exchange cryptocurrency.” The platform currently supports Bitcoin, Ethereum, Litecoin, Bitcoin Cash and Ripple and claims to be offering the “best available rate with no hidden fees.”

There are no deposit fees, no subscription fees and no exit fees for using the service. The rate is derived from a partner cryptocurrency exchange Bitstamp. Additionally, Revolut charges a 1.5% markup on the average exchange price to account for volatility.

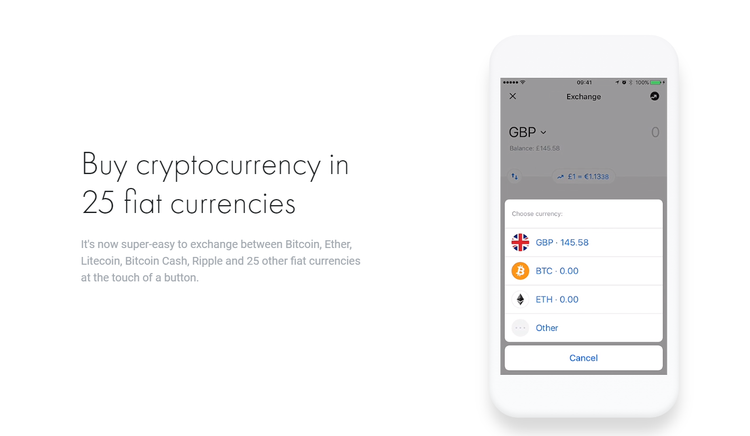

Revolut gives its customers instant access to cryptocurrencies in 25 fiat currencies, including USD, GBP, EUR, PLN, CHF, DKK, NOK, SEK, RON, SGD, HKD, AUD, NZD, TRY, ILS, AED, CAD, HUF, JPY, MAD, CZK, QAR, THB, and ZAR.

Unlocking cryptocurrency offering

Considering the high demand for cryptocurrencies, the feature is open to Premium customers only, but regular customers can activate cryptocurrencies by inviting friends to Revolut. Once three friends successfully join the service, the user will be upgraded to Revolut Premium and will therefore have immediate access to cryptocurrencies.

Converting cryptocurrencies

Once the cryptocurrency offering has been unlocked and activated, customers can use supported fiat currency to gain cryptocurrency exposure or exchange this exposure back for a fiat currency.

Buying and selling the cryptocurrency exposure works the same way as any other fiat currency supported by the service. The cryptocurrencies are converted from or to fiat instantly.

To add a cryptocurrency account, it’s necessary to click on 'Add account' in the 'Accounts' section and select any of the three cryptocurrency accounts. Cryptocurrencies can also be sent to a friend. It’s only necessary to tap on the 'Payments' tab in the app, then click “Send money” and select anyone with an ‘R’ next to his/her name, enter the amount and chose the type of cryptocurrency to be sent.

For now, Revolut does not allow transferring cryptocurrency to an external wallet outside the platform. The platform pledges to improve its feature and hopes it will be possible to send and receive transfers from/to external wallets in the future.

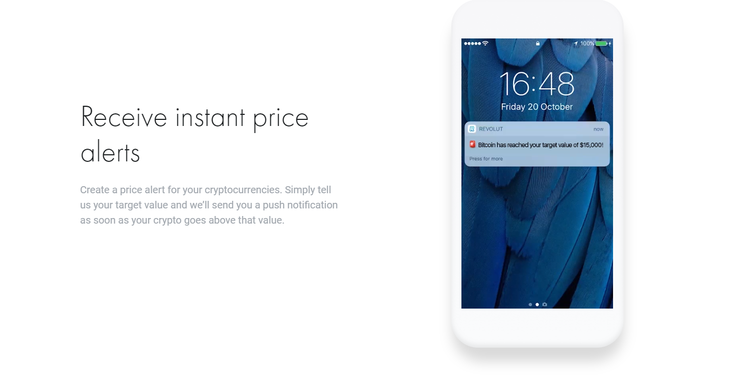

The platform imposes limits on cryptocurrency exchange, allowing €15,000 per single exchange and 30 exchanges per day. Revolut also allows to follow the real-time cryptocurrency exchange rates from anywhere in the world. The service will also send instant price alerts. If you tell your target value, Revolt will send a push notification, as soon as the selected cryptocurrency goes beyond that level.

Cryptocurrencies cannot currently be spent directly via Revolut card, they should first be exchanged to any supported fiat currency.

Revolut planning to go global

The London-based banking platform is planning to expand its cryptocurrency app reach and is targeting countries like the U.S., Canada, New Zealand, Singapore, Australia and Hong Kong, CoinFrenzy reports.

Revolut currently allows instant transfers across borders in more than 140 nations. The platform claims it is signing up 6,000 new customers per day and has a user base of two million customers, one million of them being from the U.K.