The Chinese bitcoin mining equipment makers Ebang Communication filed for an Initial Public Offering (IPO). If the application is approved, the company's shares will be traded on the Hong Kong Stock Exchange. The company filed the documents today, June 25. This is a preliminary proposal, so it is unclear how much the company is valued and how much it plans to attract during the IPO.

Why it is important

- This is already the third major producer of miners from China, which is applying for an IPO. Each of the projects claims to be the first representative of the blockchain sector on the Hong Kong Stock Exchange.

- Attracting funds through an IPO will help the mining business to develop new directions. In addition, shares of companies related to the cryptosphere may be attractive to investors who are afraid of high volatility of digital assets.

In May, Reuters reported that Ebang Communications is in talks with consultants about the IPO. The report said that the company plans to raise up to $1 billion. In this case, this IPO can become the largest in the crypto industry.

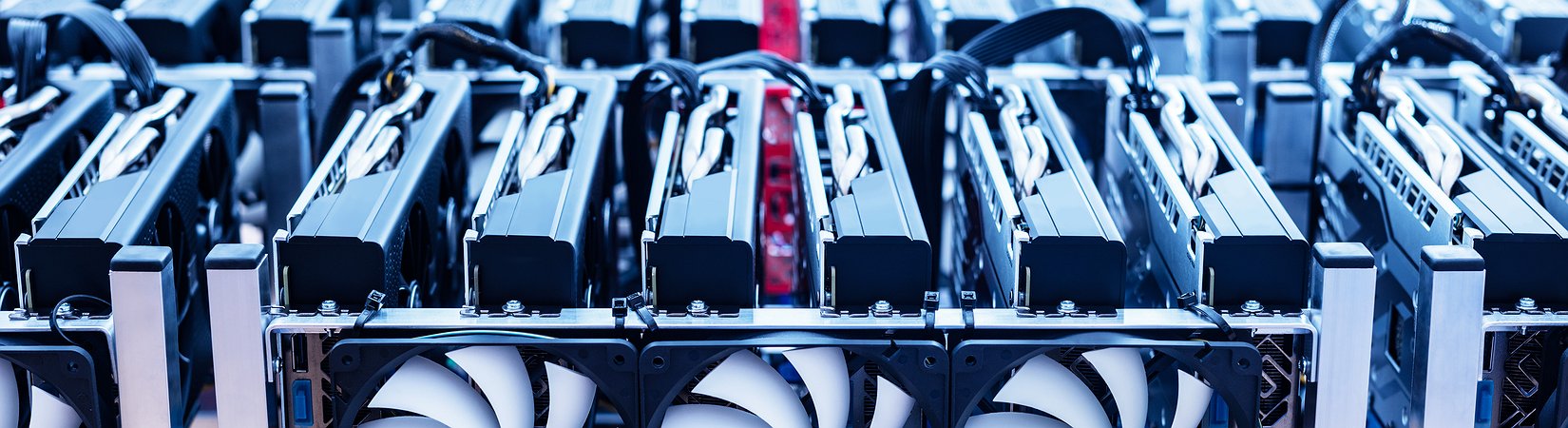

The application says that the company's revenue for 2017 was $141 million dollars (925 million yuan), which is 17 times more than in 2016. Net profit was 34 times higher than a year earlier - $ 60 million dollars (380 million yuan). 94.6% of total revenue at the moment is sales of miners.

Ebang Communications was founded in 2010 and initially, the company produced electronics and software for the telecommunications industry. In 2016, Ebang released the first Ebit miners and began to compete with Bitmain.

In May, it was reported that Canaan Creative, the second-largest Chinese producer of equipment for bitcoin mining, intends to hold an IPO on the Hong Kong stock exchange. The company also intends to raise $1 billion. In addition, in June, it became known that the world's largest producer of equipment for Bitmain mining is going to conduct an initial public offering.

By Ekaterina Ulyanova