Chinese insurer firm Anbang will reportedly give up its bid to acquire Fidelity & Guaranty Life (NYSE: FGL.NYSE) for $1.6 billion after failing to obtain regulatory approval.

It would mark the second time time the Chinese firm has abandoned a bod to takeover a US firm following its unsuccessful pursuit of Starwood Hotels & Resorts Worldwide Inc for $14 billion last year.

Anbang got the all clear from the Committee on Foreign Investment in the United States (CFIUS) but failed to win the approval of a number of US state regulators.

Anbang signed a merger agreement with Fidelity back in 2015. It was due to expire in February but the firm had it extended until today (April 17). If Anbang had secured a public hearing with regulators in Iowa it could have further extended the agreement.

But the firm has failed to meet the requirements for another extension, sources told Reuters.

Had Anbang successfully sought an extension the firm would have still needed to secure the approval of regulators in New York. But that effort has now been abandoned, the sources said, who did not say why Anbang could not win the approvals it needed.

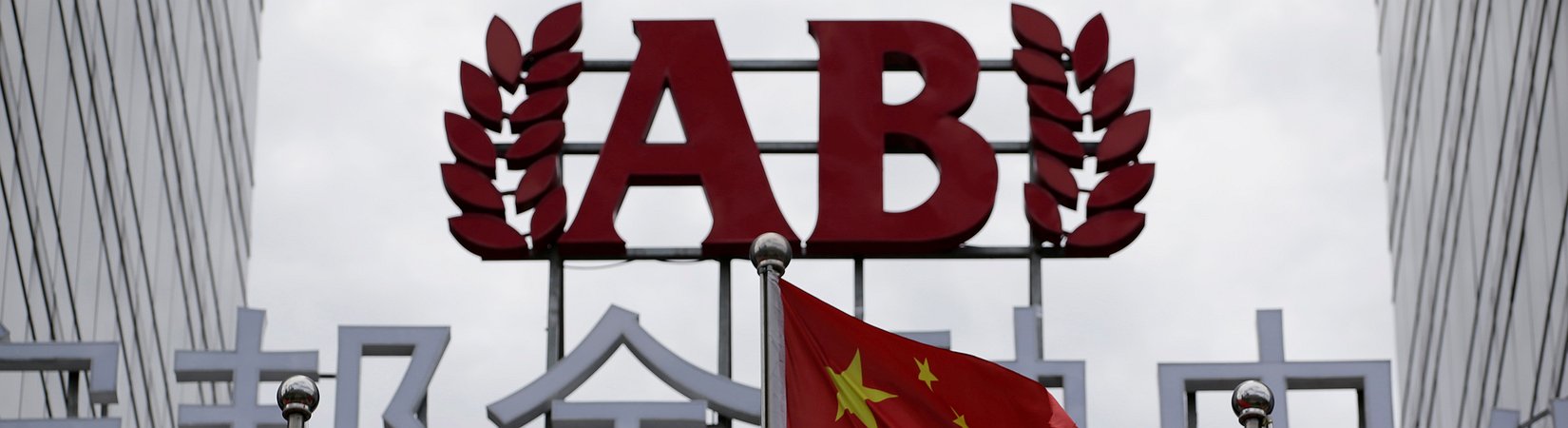

Anbang was established in 2004 but has risen to international prominence over the past two and a half years through a series of high profile foreign acquisitions.

The group is owned by 39 little-known private companies from across China.