Swedish Arcam AB together with Germany's SLM Solutions Group will be acquired by the industrial giant GE for about $700 million each, as part of GE's aggressive transformation plan.

Yesterday, the company has announced its plans to acquire 2 companies offering additive manufacturing (3D) equipment that is meant to boost GE's developing metal-based 3D manufacturing projects. This is not yet just another company's test project that involves the latest industrial production technology but rather a serious initiative as GE (Milan Stock Exchange: Gefran [GE]) plans to grow their young 3D manufacturing business to generate $1 billion by 2020.

General Electric's Swedish local firm made a $685 million bid for the Swedish Arcam AB (STO: ARCM) that pioneers 3D manufacturing with their patented electron beam melting machine. Previously, Arcam was mostly catering to customers in aerospace and healthcare industires and made about $68 million in revenue last year, reports BusinessWire.

At the same time, GE's German unit placed a bid for SLM Solutions Group (ETR: AM3D) based in Lübeck for $762 million or €38 per share. The company offers laser machines for metal-based 3D manufacturing and generated $74 million of revenue in 2015. Both of the companies offer pioneering solutions for metal-based additive manufacturing that will now be part of GE's growing 3D production business.

“Additive manufacturing is a key part of GE’s evolution into a digital industrial company. We are creating a more productive world with our innovative world-class machines, materials and software. We are poised to not only benefit from this movement as a customer, but spearhead it as a leading supplier,” said Jeff Immelt, the CEO of GE.

This is a very generous bid for the two companies whose combined revenue is about one tenth of the acquisition amount offered by GE. The company also promised to keep the office locations and employees intact while they will be managed by GE Aviation unit.

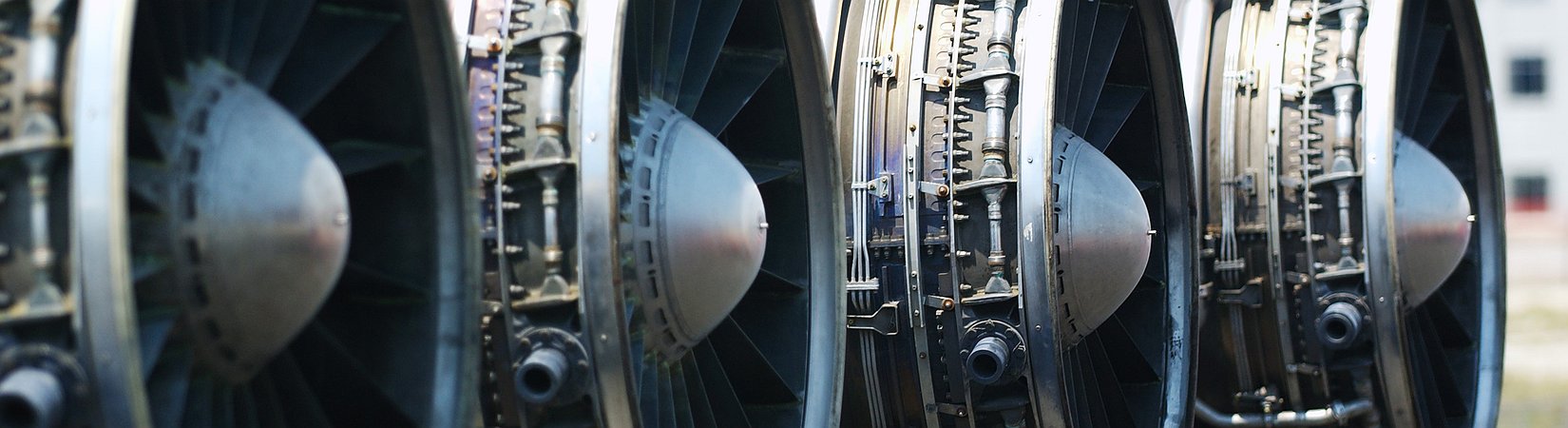

Since 2010, GE has already invested over $1.5 billion in development of 3D manufacturing and it seems like the company is just starting out. By now, GE has introduced 3D-based production in 6 of its businesses and issued over 300 patents in metal manufacturing. What is more, a newly-built 125,000-square-foot factory in Pittsburgh is another GE's project to jump in front of the rivals in this young industrial industry.

By pursuing 3D production, GE wants to adopt the technology that allows manufacturing components that are lighter and much more durable than traditionally-produced ones. They are free from traditional manufacture restrictions and give more freedom for engineers to customize and control the process. Also, it "dramatically expands" the design possibilities, says Joyce.

“We chose these two companies for a reason. We love the technologies and leadership of Arcam AB and SLM Solutions. They each bring two different, complementary additive technology modalities as individual anchors for a new GE additive equipment business to be plugged into GE’s resources and experience as leading practitioners of additive manufacturing," said Joyce.

What about GE stock?

Last year was a turning point for the company in terms of switching to the (digital) industrial direction and cutting down on some parts of its business. In April 2015, GE decided to get rid of the large portion of GE Capital assets, the company's financial business that offers financial solutions in commercial lending and leasing and previously accounted for half of GE's overall profits. It was part of GE's plan to emphasize its industrial focus and dive deeper in that direction. Therefore, the company announced that all Capital assets that are not directly related to the Industrial business would be sold off.

However, regardless of this and other bold moves in the name of their business transformation, some analysts say that investors shouldn't be too bullish about GE's plans.

"As the hysteria around transformation fades, and the focus shifts to actual numbers, what's left is a core, fundamental outlook for earnings and free cash flow that we think is at best stable, at worst deteriorating, and undoubtedly below consensus," wrote J.P. Morgan analysts.

Next to that, the company bought their own shares for almost $14 billion this year, which is also not a very good sign considering the current stock price. At the same time, GE stock remains high even though the company has demonstrated relatively weak quarters in terms of orders and margins, says the analyst Josh Arnold. Arnold believes that there is a strong disconnect between business fundamentals and GE's stock overvalued price at the moment. Therefore, investors would be better off staying away from investing in GE right now as the stock price is likely to respond to the company's inconsistent performance soon. As of writing, GE stock trades at $31.29.