Over the last five years, Bitcoin has undergone a significant shift in perception. It evolved from a highly volatile and risky asset to a class asset, subject, like most financial instruments, to macroeconomic factors. The Federal Reserve's monetary policy has gained particular significance for Bitcoin as institutional investors have saturated the crypto market.

During the bear market of 2022-2023, Bitcoin responded sharply to the Fed's strategy of raising the key interest rate to combat inflation. The cryptocurrency declined in response to the news of another rate hike, highlighting its dependence on substantial liquidity. As of 2024, the situation hasn't undergone drastic changes, contributing to the market's tension.

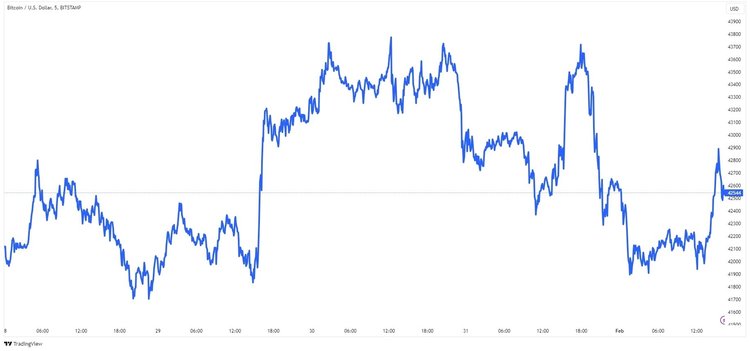

At the recent meeting, the Fed's decision to maintain the key rate at around 5.5% came as no surprise. While over 99% of investors expected this outcome, the news is now perceived negatively in the context of recovering investment activity. Consequently, the US dollar strengthened, and investment assets began correcting. Particularly noteworthy were the remarks of the department head, Jerome Powell.

Powell mentioned that inflation exhibits a high level of stability, reaching up to 3.4%, complicating the achievement of the 2% target. Faced with this challenge, Powell ruled out the possibility of easing monetary policy until inflation consistently moves towards the 2% target.

Despite breaking the downtrend pattern and consolidating above the crucial $40.5k level, BTC USD continuing downward movement is a realistic scenario. While the Fed meeting didn't cause substantial harm, Powell's statements afterward could potentially undermine Bitcoin's fundamentals. Additionally, challenges have emerged from spot BTC ETFs, displaying disappointing results and negatively impacting investor sentiment.

Besides the negative outlook on the Fed's monetary policy, the launch of the BTC ETF failed to meet investor expectations. According to JPMorgan, the ETF's performance has been disappointing, with net inflows totaling just $857 million in the first 9 days of trading. Despite this, investments are still flowing into ETF products.

The combination of the Fed meeting outcome and the weak performance of the BTC ETF is putting the brakes on Bitcoin's upward momentum. The upcoming weeks are expected to be cautiously pessimistic, leading to reduced trading activity in the crypto market. Investors will closely monitor labor market and inflation data to shape expectations for the next Fed meeting.