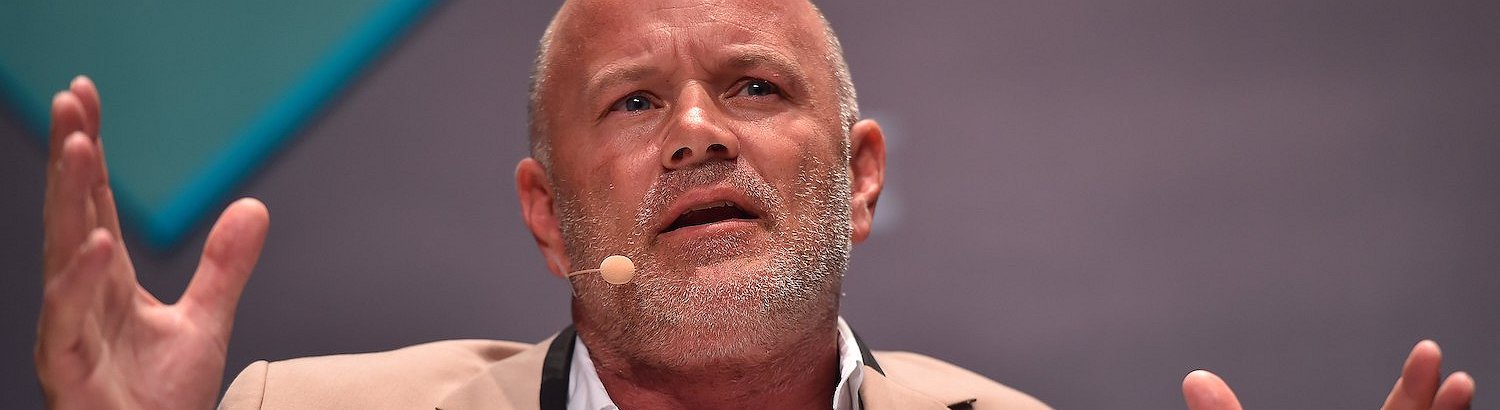

Mike Novogratz, CEO of Galaxy Digital, has repeatedly stated that, in terms of capitalization, Bitcoin could overtake gold in the medium term.

However, he has recently said on Twitter that, in his opinion, these two assets do not compete, but complement each other perfectly.

The precious metal and Bitcoin can equally be considered as hedging instruments. According to him, these assets will protect investors' capital from inflation.

Moreover, the trend towards the depreciation of fiat currencies has already formed, and we will soon see how global economic problems will negatively affect the dollar and other leading currency units.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.

Novogratz has pointed out:

"Everything doesn’t have to come from a position of either or. The gold charts look good. You can be bullish gold and $BTC. Both are perceived as stores of value to protect against debasement of fiat. Gold underperformed for a while. $BTC and crypto are in an adoption cycle."

Jurrien Timmer, head of Global Macro at mutual fund giant Fidelity Investments, said last year that Bitcoin's finite supply was a big advantage over gold. A recent report published by the Boston-based investment giant has reinforced the "better than gold" argument.