Cryptocurrency derivatives provide a simple way for traders to gain exposure to a wide variety of digital assets without necessarily having to hold those assets directly. This, along with some of the unique features derivatives contracts offer, has led to a staggering increase in their popularity since the first major Bitcoin futures launched in 2017.

Now, cryptocurrency derivatives are rapidly catching up to the cryptocurrency spot trading industry in terms of trade volume. Here’s why.

Growth of the Industry

have grown significantly in the last 18 months — more than quadrupling during this time and gaining 32% between April and May 2020 alone. A staggering $600 billion in cryptocurrency derivatives are now changing hands each day.

📈📊 #Crypto derivatives continue to gain market share against spot markets

— CryptoCompare (@CryptoCompare) June 8, 2020

In May, derivatives volumes hit a record $602 bn, while total spot volumes hit $1.27 tn.

Derivatives therefore represented 32% of the market (vs 27% in April).

Read more here: https://t.co/ekG7OYmoN7 pic.twitter.com/jtMJ70t5tA

Another recent report indicates that the derivatives trading volumes in Q1 2020 were more than 300% higher than the average quarterly volume seen in 2019. Should this growth continue between 2020 and 2021, then the size of the derivatives could begin to approach the size of the spot market by next year.

Much of this growth can be attributed to an overall increase in the number of traders, but advancements in the simplicity and functionality of cryptocurrency derivatives trading platforms have made derivatives trading far more accessible than they once were. Now, even the least experienced traders can confidently trade derivatives just as easily as spot markets.

Safety and Security First

As with any trading platform, the safety and security of user funds should be paramount. However, in the case of spot trading platforms, this has not been the case for the most part, as hacks, thefts and data breaches have grown to become the bane of the industry in recent years.

Back in May 2019, Binance, the world’s largest spot exchange by trading volume, was hacked to the tune of $40 million, while the vast majority of all Bitcoin stolen in the past came from breached cryptocurrency spot exchanges. Part of this is due to a lack of accountability in the space, with most spot exchanges operating without a license in a jurisdiction that eschews corporate responsibility and consumer protection.

Derivatives exchanges, on the other hand, have managed to avoid the same issue by doing more to keep user funds safe by investing in the infrastructure needed to thwart hacking attempts. This includes the common use of multi-signature cold storage and the implementation of various additional customer-side security options, such as withdrawal address whitelists and two-factor authentication.

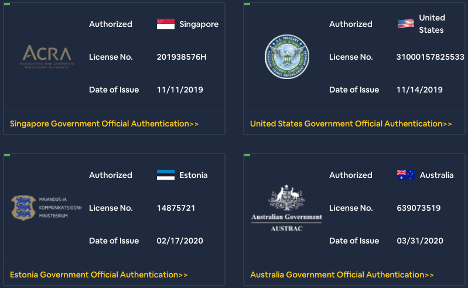

Some derivatives exchanges have even gone above and beyond the call of duty to make their customers feel safe. These include Bityard, which recently became the world’s first derivatives exchange to obtain licenses in four countries, while offering perhaps the only full refund warranty on deposits in the industry.

Power to the Trader

In the last three years, cryptocurrency derivatives exchanges have risen up to become the platforms of choice for crypto funds, high net worth traders and professional traders, due to the variety of benefits they offer over standard spot trading platforms.

Among these, it is the capacity to trade with leverage that first draws many traders to derivatives trading platforms. By opening positions with leverage, traders are able to easily multiply their exposure to market movements, allowing them to turn a much higher profit than when trading without leverage.

Currently, some of the most advanced cryptocurrency derivatives exchanges offer up to 100x leverage for some trading pairs — this means traders can multiply their profit on winning trades by a factor of up to 100. That’s the equivalent of opening a $100,000 position with just $1,000 balance and turning a profit of $5,000 if the asset price climbs 5%.

This is particularly impressive when you consider that derivatives allow traders to easily speculate on the short side, which means they can turn substantial profits even while the market is on the decline — something that is very difficult to do when trading spot.

The ability to profitably trade bear markets and the capacity to open sizeable positions with a small starting balance make derivatives trading the ideal way to hedge spot positions. After all, with as little as 1% of the spot balance, it’s possible to complete hedge out spot risks, allowing traders to protect their investment on the cheap.

Thanks to significant improvements in usability and accessibility, even retail traders are beginning to make the switch to derivatives exchanges in an effort to maximize their returns and better control their risk exposure.