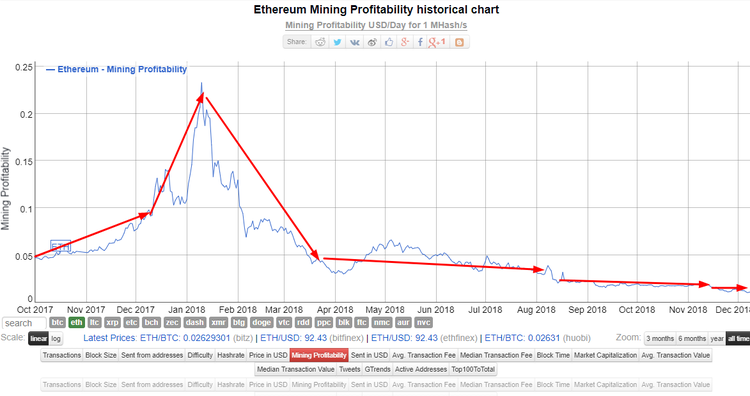

When the cryptocurrency rate drops against the dollar, the profitability of mining begins to fall. Then given the heavy electricity costs, at some point, it becomes unprofitable to mine and you start operating in the red zone. But some miners continue their work, in the hope that tomorrow the rate of crypto will start growing. Unfortunately, it continues to drop.

What actually is going on, let's have a closer look into the mechanisms mining depends on.

Using ethereum as an example - third largest cryptocurrency by market cap, after bitcoin - we can see how these processes take shape in real life.

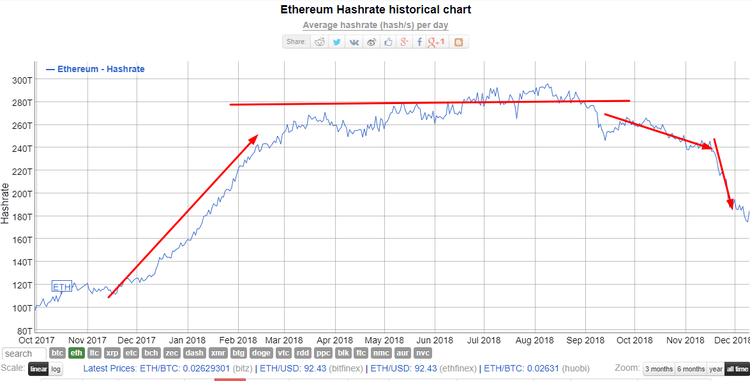

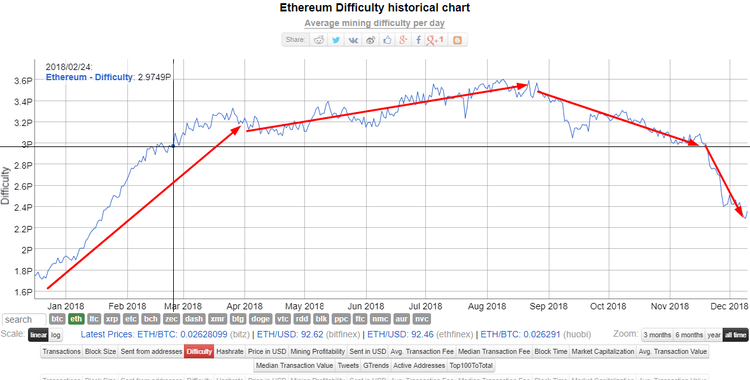

So, the exchange rate to USD of cryptocurrency falls, as well as the profitability, everyone has been waiting for its growth for a long time, but at some point, the patience runs out and a lot of people turn off their miners. Thus, as soon as those miners turn off, the network's hash rate begins to fall. And we can see it on the chart above.

As soon as network hash rate falls, the share of reward in the cryptocurrency starts to increase for each miner that remains on the network.

To make it clear, a certain amount of coins is issued per day as a reward, and it does not change. Let’s imagine a potato field: if a million people pick potatoes in the same field, then everyone gets a small part of the total amount. The size of the field can be changed but the amount gathered will be the same, pure and simple. So, just compare two fields where on one there is a million players and another identical one, where there is just a hundred of them. When the amount of players increases, the field grows, but the amount of potatoes remains the same. As a consequence, if there are five players in the field, the whole amount of potatoes can be shared among them and field will be small enough to find all in one day).

So, when the crypto rate falls, there are more coins to be picked up, because some choose to leave the market and stops mining. The turning point should happen when the rate of crypto drops significantly and only those players can remain, that have the cheapest electricity. If they leave too, then in theory coins will run out. Even if it becomes unprofitable for them to mine, there will be no coins. But It should be said, that there will always be someone who will mine, despite having no profit and even spending money on it for some reason or another. It is all about those people who believe, who are ready to invest in mining. We should remember, that initially the coin or a token carries no value. Someone just turned on their computer and started mining, made some calculations and got no money for it, he just believed in this idea. Afterward, this idea began to monetize.

Nowadays we can see, that a lot of miners turn off their devices, primarily because of the electricity costs. The hash rate of networks is plummeting. And those people, who have more beneficial conditions of location get a bigger share. We can’t predict whether it will increase or fall further on, but one thing we can all acknowledge is that it hasn’t been seen falling for a long time, and even increases a little.

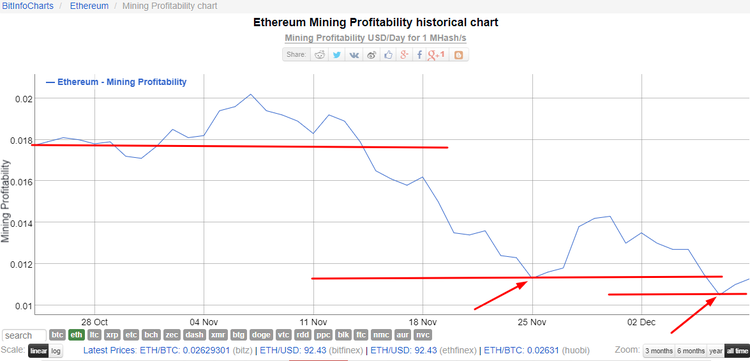

Let’s contemplate a short outline of how it is happening. So, we can see, that the value per one unit of ethereum’s mega hash is $0,0105 and we can see that here is the value, below which the profitability does not fall, no matter how low the crypto rate gets (according to the time of writing).

Let’s imagine an extreme situation when ethereum will not cost $100-150, but $50. This certainly does not mean that the profitability from mining will fall, this means that more miners will be turning away from the market, and the remaining miners may have the same profitability rate, as they had before that rate dropped. And the main question to a big player in the mining market is: where is the lowest value of profitability?

This is now a perfect place to emphasize the advantages of the liquid cooling system. Power Usage Effectiveness, which is 1.05 should be singled out above all other advantages such a system has. This means, that we can spend just 5 percent on top of the electricity costs to cool the equipment where we also spend 100 percent on the electricity itself. Loosely speaking, it comes to 105 percent of electricity. If we compare this system with air cooling, we can see, that PUE of even the most effective data-centers using air cooling will be only 1.2. Hence, we get 120 against 105 percent. It goes without saying, that if two miners work under the same conditions, the one with air cooling, that consumes additional 200 watts per 1 kWh will be turned off faster than the other one that makes use of liquid cooling, as it additionally consumes only 50 watts per 1 kWh.

This is only one of the numerous advantages, that shows how effective and profitable the miner can be if it uses liquid cooling in comparison to all others that work using air cooling in self-made mining rigs. One can make an earning with such rigs only when everything is on a high. Usually, miners try to quickly make a return on their investments and the sell the rigs. But when you are trying to earn money professionally and over a long-term period by investing a lot of money, devices with the liquid cooling system can help you to make a neat profit. And when then crypto rate falls and a huge amount of miners begin to leave the market, you know that all your mining competitors with whom you are holding this field now, they will leave faster than you.

It should be understood, that there are many reasons why people leave the mining market: it’s unprofitable to mine, expensive electricity; inefficient equipment; passage of a bill in the country (e.g. the rise of electricity prices), regulatory restraints and the last, or the most important factor is the low profitability.