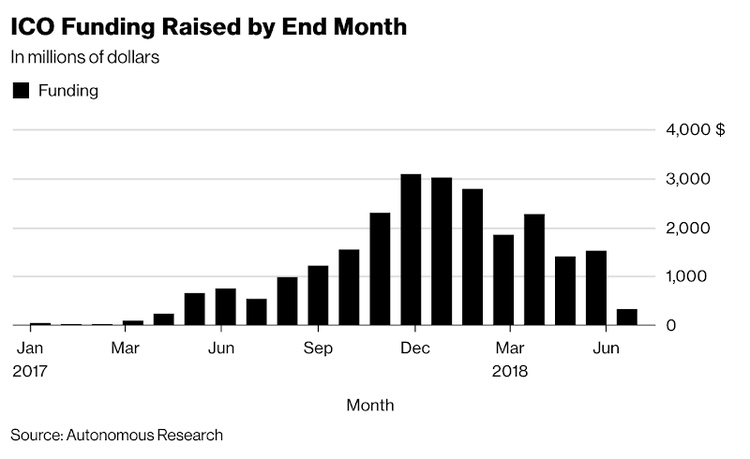

The latest data on the volume of funds invested in ICOs lends itself to rather harsh statements — the market has collapsed. Thousands of projects collected millions of dollars in exchange for a promise to release the fastest blockchain or the safest cryptocurrency. And where are they now? Still waiting! Those who survived have to now prove their investment attractiveness and why they still need those tens, hundreds of millions of dollars they’ve gathered. In the meantime, just take up trading or hold on to the assets you’ve acquired. There's no point for participating in an ICO.

One of the main problems with ICOs is that the attracted money in no way, shape or form correlates with the real needs of the company. Participating in numerous conferences and undertaking expensive marketing campaigns does not lead to the development of a real product. The idea to quickly deploy some kind of a blockchain to the whole world - and for it to generate back the invested millions - has failed dramatically so far. With an average reasonable investment in a startup from the ‘fintech’ industry being at around a million dollars, everything else grows dim, which we have observed in recent months.

The idea that with the help of a fancy website, a simple document outlining the plans, famous "advisors", which are designed to serve as a magnet to attract the attention and you can make a lot of money, is very pleasant indeed. Moreover, there are enough technological problems. We really need faster blockchains, safer cryptocurrencies and everything else we all dream of, regardless of whether we are earning or giving money. But, such technologies are not yet here. Most of the projects still don’t have a working product and a distinct business model. The likelihood that the owners of their tokens will get the desired number of zeros in profit remains to be seen, especially when there are still debates over their legal status.

From the point of view of a potential investor, the ICO procedure does look attractive, but only if the token would actually guarantee something. But as it turned out, no blockchain or smart contract will safeguard you from scammers, project failure of the disinterest of its creators. Insurance provides you with an opportunity to go to court. As it happens, slowly, but surely the number of cases against those who promised untold profits steadily increases. At the moment this only concerns those who promised that tokens will be tied to something valuable, but soon this will touch upon the technological projects, as they will inevitably have to show something. And if the product disappoints — we all know the drill: SEC, investigations, seizures of property and so on.

Whatever drives the idea of collecting a lot of money, coming up and promoting a project - the absence of barriers in the form of hated funds, meticulous investors and expert community only harm your business. The practice of ‘Friends, Family, and Fools’ is still applicable to find tens of thousands of dollars for a hypothetical launch of the product is not a difficult task today. Write a business plan, work out a model, find out where the money and the audience are that will lead to configuring the necessary requirements, through which everyone must go through. If they are not respected, the probability of failure is much higher.

Any investment is a responsibility of all the parties. The investor should think each step thoroughly, conduct the due diligence, study the project and if this is not done, the money will be wasted. So those who take the money must understand that they will be responsibly called to an answer. Frankly speaking, investors shouldn’t take a nice wrapper, a mysterious ERC-20 format, but a share in the company. This process should be regulated softer, but still by the same principle as any joint-stock company follows. If both sides do not feel they can be responsible and feel secure, nothing will happen.

Today, countries that have paid attention to the industry are working on a legislation to conduct an ICO. No matter how attractive this form of freedom is, no matter what consensus is offered by the technology, without the external control and audit, we see a wild west situation, which is characterized by constant failures. Perhaps the new environment and technologies require those immense injections that have been made in recent years, but statistics say otherwise - chaos has created uncertainty, the latter has led to a drop in the number of funds attracted. Regardless of who’s the guarantor in this process, one thing is necessary.

A decision to participate in an ICO usually comes from the desire to spend the loose cryptocurrency, expand the portfolio of digital assets in the hope of accidentally flying to the moon on top of a Lamborghini - but today this is the most unreliable way. Crypto fever gave us thousands of cryptocurrencies, most of which are failures much like the ICOs, but among them, there are probably a few diamonds.

Bitcoin takes up around 60% of the market. If you add the main currencies, ethereum, litecoin, XRP - very little space is left for the rest, but the number of those only seems to grow. The share of ICOs which were lucky enough to reach the exchanges is even smaller. Despite the turbulent market and constant events, the most reliable way is to buy the bitcoin and to keep it. If you really want to play then buy altcoins, preferably somewhat well-known. Participating in an ICO, so far does not make sense, if you end up in court, you’ll get nothing.