Andrey Movchan, a senior fellow and director of the Economic Policy Program at the Carnegie Moscow Center, has shared his vision of the future of cryptocurrencies.

They say the less you know on the topic, the more you want to speak out. I will speak about cryptocurrencies.

There’s theft and volatility, endless forks and confusing modifications, fortunes lost because of a forgotten password, arbitration margins of as high as 30% and transactions taking as long as weeks; there’s drugs and arms trade, brutal price manipulations, and governments unable to tell you whether your actions are legal or not.

And that's how everything new starts.

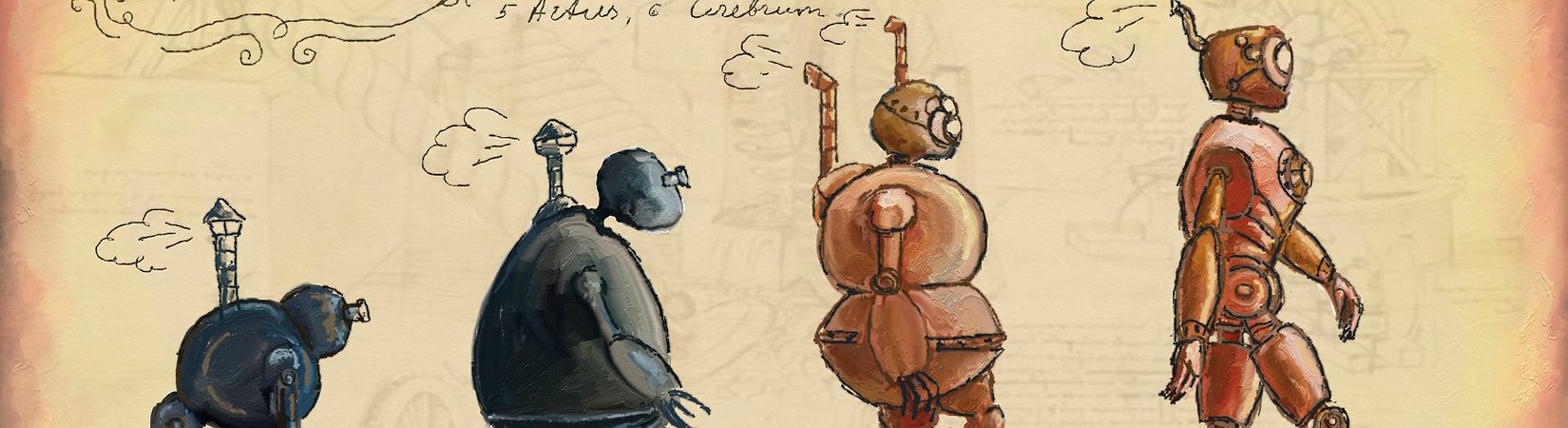

The first cell phone to hit the market weighted 5kg and looked more like a briefcase; the first cars were a nightmare both for the driver and everyone around; the first pistols were easier to throw out and get by with a sword; the first aircraft did not fly, but rather jumped 10 meters at a time; I’m pretty sure the first stone ax made by some unfortunate Erectus caused only the spiteful laughter of his fellow tribesmen. It's not about the markets being not ready or the regulators being too skeptical. Cryptocurrency as it is now is meaningless and ugly, as has always been the case with pioneering initiatives. But more perfect types are soon to come.

It wasn't that long ago, just at the dawn of the 90s, that security trading was made legal in Russia. At first there were Chara, Khoper-Invest, and Hermes Foundation, then MMM and Bashkirian Gasoline. All these turn out to be mere Ponzi schemes. They did cause a stir, and their creators made fortunes; and they were just as meaningless as modern cryptocurrencies. But before long there were RAO UES, Gazprom, Russian Eurobonds, GKO and OFZ bonds.

Today’s cryptobastards are not secured by anything and definitely not worth buying. They are as unreliable as Tu-154 and as unhandy as a frying pan made by a former Russian tank factory. But this does not in any sense mean that in the future they will not be replaced by more sophisticated cryptocurrency systems. And the future usually comes fast.

The core ideology of this new means of payment will by no means be the distributed ledger principle. We have seen already that its much-vaunted security, not to mention convenience, is often an illusion. I’m not saying blockchain won’t find its place in the data handling industry, and it is an important breakthrough in some sense, but the main thing about cryptocurrency is that it’s merely an implementation of an old math joke known as “infinite guests in hats”.

Imagine that you are visited by an infinite but countable number of guests, and everyone is wearing a hat. They take off their hats and put them on a hanger: the first guest hangs his hat on the first hook, the second guest uses the second, and so on. Then, while they are having fun at your place, a thief steals the first N hats from the hanger. How to make sure that the guests won’t notice their loss?

The answer is pretty simple: just the let the first guest to have the N+1st hat, so that the 2nd guest will have the N + 2nd hat, and so on. Since both the guests and the hats are infinite in number, everyone will receive a hat.

And this is exactly how ICOs work, including the one planned by Telegram. A company issues tokens to be used as a currency within its ecosystem (and it really does not matter how exactly the transactions will be registered and stored). At the ICO, the company sells X tokens for Y dollars.

The company spends Y–n dollars to develop the core functionality (where n dollars goes directly to the founding fathers) and rolls out the product. Let’s suppose it's well-designed and it is, in fact, more convenient for the participants to handle payments in tokens instead of dollars. That means the providers will set the price for their goods and services in cryptocurrency, creating demand for the tokens, so that their turnover through the system will increase over time.

Now, there is only a limited number of the tokens, so increase in turnover will result in their appreciation. With this in mind, a reasonable investor assesses the turnover growth prospects and get in the ICO. Later they will sell their tokens to those who want to use the platform. They, in turn, will use it to pay for desired goods and services. At last, the providers will sell the tokens outside the platform, presumably to their new potential customers. At that point, the initial Y dollars fell out of the system completely, they are not needed anymore. The company, pretty much like the thief who stole hats, doesn’t have anyone to return the money to, and can instead use it to facilitate the development; moreover, the company can as well introduce commissions for transactions on the platform, and earn on it. And if the turnover continues to grow, other participants will be eager to trade the tokens elsewhere, so the price will grow too. For speculants, the price increase isn’t actually so important, as they prefer to buy a token and sell it immediately, but there might be long-term investors as well who will buy and hold, thus reducing the number of the tokens available and pushing the price even higher.

What kind of tokens have a chance to follow such a pleasant scenario? Well, the main condition is a growing turnover in an environment where the token is more convenient than any fiat currency. The Gram can actually become the first of its kind, as the Telegram ecosystem encompass millions of customers, of which many reside in countries with inconvenient and isolated payment systems, and some are involved in cross-border transfers of funds. Then I would expect Facebook to follow, and then probably Google, Amazon and other tech giants.

The “classical” cryptocurrencies were intended to become an universal means of payment. As a result, there is no stable markets either for Bitcoin (EXANTE: Bitcoin) or for other digital money (except for the rumors that it’s a good way to pay for drugs and porn or to launder money). That is why, despite the hype, hundreds of altcoins remain weird hybrids of a Ponzi scheme with some forex stuff. New cryptocurrencies will be smarter. We are heading to the future where thousands of semi-independent payment ecosystems are common, each using its own tokens and its own way to handle transactions. Blockchain, in particular, will most likely be used in ecosystems dealing with property rights.

So, no matter what you think about Bitcoin (and if you do not want to lose your money you’d better be very cautious), we will see a real cryptocurrency boom soon, and those who will be able to pick up a proper ICO will make a fortune — let alone the founders.

So we all have to study, get a foothold in the market, and gain expertise.