Beside fascinating stories about how a crypto-enthusiast turned out to be a "visionary" of his time, believed in cryptocurrencies and became the owner of an innumerable wealth, we almost always forget that these crypto-enthusiasts are ordinary people who have families, unexpected hobbies and very uneasy character. Insider.pro has found out what makes up the richest people in crypto world.

Chris Larsen: Vietnam and Credits

The richest person in the crypto world - Chris Larsen is the founder of Ripple, whose fortune reached $20 billion in January 2018 market peak. Although Larsen left the company more than a year ago, he still acts as an executive director and stresses that he is "100% focused on Ripple and helps the team in any possible way".

However, before Ripple Larsen successfully led the Prosper start-up. The idea of this business was suggested to Larsen by the Vietnamese community. In 1983 a family of seven immigrated from Vietnam to the U.S. with barely enough money to rent a studio. But there were other Vietnamese people in the city that have gathered up some money and gave the family a loan. The family bought a second-hand car and started a gardening business. The girl from this family - Lina Lam became Larsen’s wife and in 2005 together they set up a new firm, which became the first online service p2p-lending service in the U.S.- Prosper.com.

In the first two years of its work, Larsen participated in the financing of more than 450 loans - each was $6,000-7,000 in average. The site began working in February 2006 and granted loans for around $120 million.

In October 2008, Securities and Exchange Commission (SEC) has banned firm’s activity as it was stated that p2p businesses trade with securities - debt receipts - and should be regulated by SEC. Many people borrowed p2p credits, because banks refused them. Only by the next year, Prosper managed to agree all the rules, which the company would follow. The main difference was that earlier creditors held an auction, lowering the rate to the borrower, but according to the new rules, the borrower received a bet based on his credit history.

Despite the fact, Larsen resigned as CEO in 2012 to take on an even bigger business - Ripple. Prosper.com however continues to successfully develop with over $115 million in revenue per year.

Michael Novogratz: Goldman Sachs & Rehab

Michael Novogratz is well known for being a hedge fund manager at Fortress Investment Group. He left the company in 2015 to focus on cryptocurrencies, even though his first cryptocurrency investments were made back in 2013. Now Novogratz is the head of Galaxy Digital LP.

Novogratz became famous due to becoming one of the most successful hedge fund managers and a very impulsive businessman. Some people believe that these features are embedded in the family, spread equally among his 7 siblings: his older brother Robert is a designer, an older sister is the founder of the Acumen venture fund, and among the younger brothers and sisters, one is a Wall Street trader, another is a sports manager, with the youngest two being a co-founder of an investment fund dealing with sustainable issues agriculture, and a writer.

His first hedge fund-like venture began when he was just four years old. Mike and his elder brother Robert went to their neighbors houses, selling them leaves: yellow for five cents, red for ten. Robert was shy, so his brother called at the door. When neighbors asked why red leaves are more expensive, Mike answered: "Look around, there are almost no red leaves!"

Novogratz started his career at Goldman Sachs as a trader in foreign exchange markets. When the financial crisis hit Asia in 1997, he successfully shorted Thai Baht and together with his team made a fortune. Michael explains his success by believing in his intuition.

Goldman Sachs is famous for its brutal corporate culture "up or behind the door," and under these conditions, Novogratz managed to succeed. In 1998, he became a partner in the firm, and a year later the IPO of the conglomerate took place, due to which Michael was granted shares in the firm.

He was appointed president of Goldman Sachs in Latin America. He had to move to Sao Paulo but never reached Brazil as he left the company. He explained his decision by the need to break his habit of "live like a rock star." After that, he admitted himself into a rehabilitation center in Arizona to work on himself and think about the future of his marriage. During the same period, he ran six marathons in the Sahara desert in just six days. "It literally brought me back to life in many ways," said Novogratz later.

Scandals on Wall Street are used to be forgotten quickly, and just a few years later Novogratz returned as a partner to Fortress Investments.

Brian Armstrong: Airbnb & Individual Entrepreneurship

Bryan Armstrong is co-founder and head of Coinbase, the most popular cryptocurrencies exchange in the world. In 2010 Brian read Satoshi Nakamoto's work on Hacker News. The idea of bitcoin immediately impressed him. "I thought that it could be an open payment network for the whole world, where everything is fast, cheap and universal.” – said Armstrong.

It took him three months to consider the idea in detail, and further half a year to make a prototype of a digital exchange. The first version was an Android app, it was called Bitcoin Android. As Brian says, the idea was simple, but the application didn’t work very well, and it was hard for ordinary people to understand. But in the process of creating the app, he realized what was needed. According to Armstrong “this platform is easier to use, it’s reliable and is the site, where everyone can come and buy his first bitcoin in a really simple way."

But before he founded Coinbase, Brian worked for companies such as Airbnb, Deloitte, and IBM in various positions, from software engineer to consultant for enterprise risk management. Perhaps it was the work in Airbnb that led Armstrong to the idea of crypto exchange. As Brian said, in Airbnb he worked on fraud prevention tools for internal use, and Airbnb himself handled money transfers between 190 countries around the world. Armstrong could see all the difficulties of network integration such as differences in commissions, geographical availability or delays in money transfer.

Another interesting fact about Armstrong is that after graduating college, Armstrong lived in Buenos Aires for a year. He is also is a vocal supporter of individual entrepreneurial activity and even wrote a book about it - Breaking Free: How To Work At Home With The Perfect Small Business Opportunity.

Joseph Lubin: Music & Internet 3.0

Joseph Lubin, a Canadian entrepreneur, co-founder of Ethereum and founder of ConsenSys. In 2018 Forbes estimated his net welfare from one to five billion dollars.

Joseph Lubin is considered to be a smart guy as he graduated Princeton with degrees in electrical engineering and computer science. Although in Princeton, he did more than just attended classes. Lubin began to gain practical experience in their robotics laboratory, where he began to define and develop his skills.

Before pursuing the idea of blockchain and finance, Lubin was developing music software that led to a two-year detour into the Jamaican music industry.

Lyubin also explained once that he "participated in various types of trade, so it would be impossible for him to miss bitcoin." Knowing the consequences and inspired by the opportunities, Lubin turned to cryptocurrencies. After experiencing the early days of the bitcoin and reading a whitepaper by Vitalik Buterin’s project about a decentralized system, Lubin joined the Ethereum project.

Lubin believes in blockchain and his work still serves as a harbinger of his intentions in the future. He recently published a public confirmation that Ethereum and ConsenSys are his primary projects, and both companies are growing at a huge pace. He believes that his projects will make up the future of the Internet, Internet 3.0, and that his platforms will pave the way for people to live in more secure, transparent and effective ways.

Although he isn’t a public person as some others in blockchain world, it’s likely that his work will be the one most widely discussed and thoroughly implemented in the future.

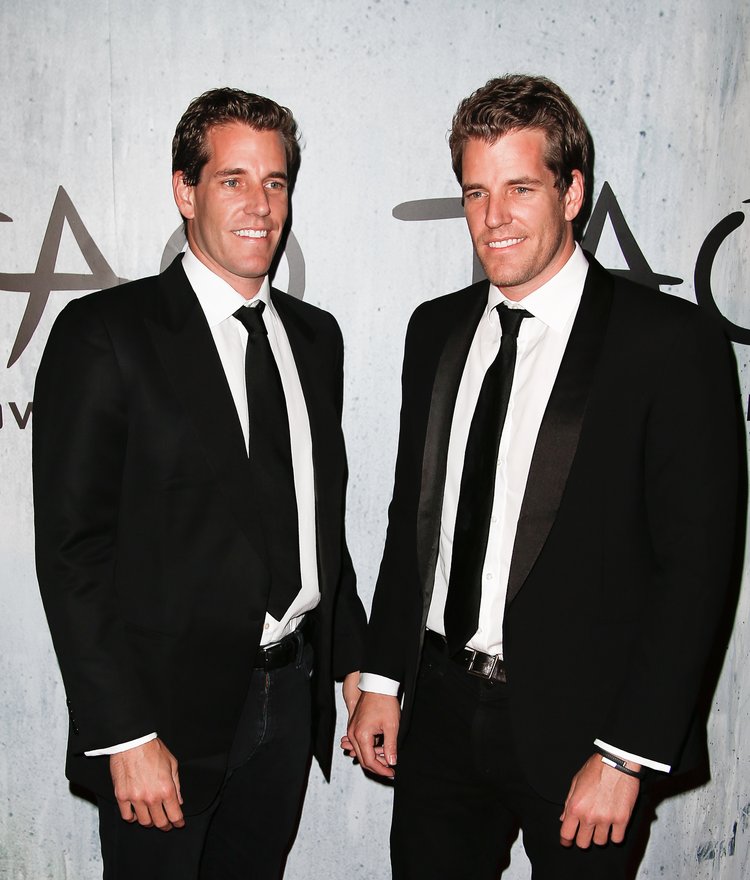

Winklevoss Twins: Olympic Games and David Fincher

The world learned about Cameron and Tyler Winklevoss as entrepreneurs that litigated with Mark Zuckerberg, Facebook’s founder, accusing him of stealing their idea of creating a social network. This story inspired a film "Social Network" by David Fincher.

What is more interesting, is that after receiving $65 million in compensation from Facebook, in 2013 brothers invested a significant amount of that into purchasing bitcoins. This "golden" purchase turned them into one of the first crypto-billionaires in the world.

However, twins have not only a talent for business, but also for athletics. For many years Winklevoss brothers enjoyed rowing. Beginning with school and continuing at Harvard University, where they performed quite well in a team of 8 called the "God Squad", which earned them a call up to the U.S. team.

In 2007, with the national team, the twins won silver and gold medals in the Pan-American Games in Brazil, and in 2008, went all the way to the final of the Olympic Games in Beijing.

The twins stand out due to their sporty looks, and their love for unorthodox costumes and have been seen accompanied by Brazilian models on several occasions.