Who is ShapeShift CEO Erik Voorhees?

ShapeShift CEO Erik Voorhees urges investors to accumulate crypto during the bear market. He predicts that the Bitcoin price will keep diving, reaching a 30% additional loss in the next 3 to 18 months, but will go no further than that.

Speaking to CNBC Crypto Trader, Voorhees said that while the bear market has evidently not ended, the worst part of the correction has slowed down.

He believes that any purchase of Bitcoin between $5,000 and $8,000 would be advantageous for long-term believers in this industry, as in a couple of years a $6,700 will look like “a good spot” to buy-in at.

Who is Erik Voorhees?

An early bitcoin adopter, Erik Voorhees is the founder and Chief Executive Officer of the ShapeShift cryptocurrency exchange. He also co-founded the bitcoin company Coinapult, which provides wallet services for both businesses and consumers. Previously Voorhees worked as Director of Marketing at BitInstant, a payment processor for various Bitcoin exchanges and other merchants, which is no longer active. He was the founder and partial owner of SatoshiDICE gambling website that was subsequently sold to an undisclosed buyer in July 2013. Erik Voorhees believes the national monetary system has essential problems and keeps his assets and finances in Bitcoin. “I'm much more confident with crypto than with banks or fiat currency because I can actually control it, and the money supply is transparent, stated up front. It makes online shopping a lot easier and a lot safer,” Erik says. Voorhees once said that “Like the Internet, Bitcoin will change the way people interact and do business around the world.” The ShapeShift CEO considers that the next big cryptocurrency surge of 2019 will be in the field of video games and its associated collectibles.

ShapeShift

ShapeShift was founded in 2014 to provide instant bitcoin and altcoin conversion. To use the service, it’s simply necessary to choose the altcoins or blockchain tokens to be exchanged, input the receiving address and send the funds.

Unlike other digital asset and bitcoin exchanges, ShapeShift doesn’t hold customer deposits, which means the users’ funds don't suffer custodial risk.

Although ShapeShift mentions “instant” transactions, exchanges can take from thirty seconds up to several hours.

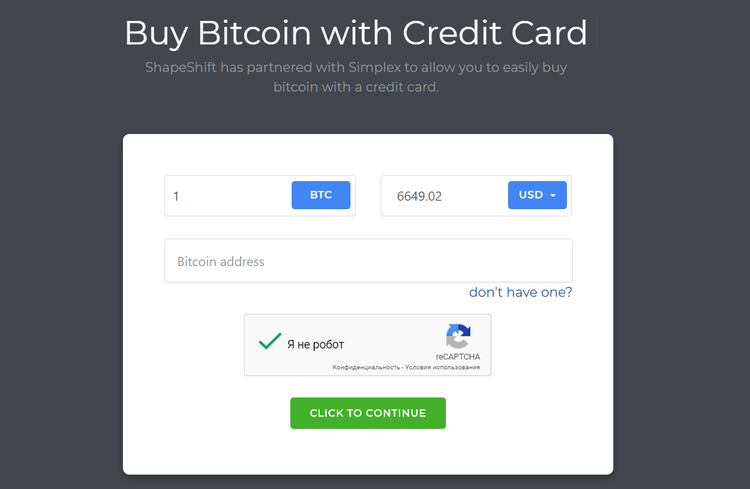

The platform also allows buying bitcoin with a credit card. to make this possible, the company partnered with the fintech firm Simplex.

ShapeShift doesn’t charge any fees for the use of its services. Instead, the company’s revenue comes from the exchange rate. All transactions are subject to a mining fee, which is set by the blockchain network.

ShapeShift has recently launched a new membership program that will eventually become mandatory for its users.

The program offers users a variety of exciting exclusive benefits such as higher trading limits, rewards on trading volume and more, Michael Perklin, Chief Security Officer at ShapeShift, wrote in a blog post. However, becoming a member requires verification of basic customer information.

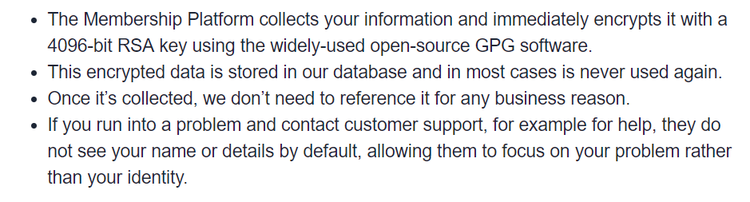

Here’s how the platform is handling user data with the Membership Platform:

Voorhees’ announcement that the membership program will "become mandatory soon," has raised concerns that it could be the end of the platform known as “the exchange without accounts.”

In this regard, the CEO has said: “I’ve also lived through many people declaring the end of bitcoin.”

Voorhees rejects BitLicense

Erik Voorhees says BitLicense - the reigning regulatory regime for New York’s Bitcoin industry, is an “absolute failure.”

In 2015 the company pulled its service from New York State because it did not wish to comply with BitLicense.

"We either would have to do something we're not comfortable with or leave New York," Erik Voorhees told CNBC. "It's a moral and ethical stand we're going take."

BitLicense, which seeks to provide consumer protection for digital currencies, asks digital currency firms to, among other things, record some personal identifying information of its users.

"We're not going to spy on thousands of people purely to make their job a little bit easier," Voorhees said of the law enforcement.

In the nearly three years since the BitLicense regulations were finalized in June 2015, Voorhees proposes regulators to simply hit the reset button: “Get rid of the BitLicense, go back to where you were four years ago.”

Erik Voorhees vs. Roger Ver

Erik Voorhees and “Bitcoin Jesus” Roger Ver entered into a spat on Twitter after the latter referenced to Voorhees to back up the claim of how bitcoin cash is the real bitcoin.

Roger - please stop referencing me to back up your opinion that Bitcoin Cash is Bitcoin. It isn't. Bitcoin is the chain originating from the genesis block with the highest accumulated proof of work. The Bitcoin Cash fork failed to gain majority, thus it is not Bitcoin.

— Erik Voorhees (@ErikVoorhees) April 27, 2018

In response, Voorhees blamed Ver for using his quote out of context and added: “Roger - please stop referencing me to back up your opinion that bitcoin cash is bitcoin. It isn't. Bitcoin is the chain originating from the genesis block with the highest accumulated proof of work. The bitcoin cash fork failed to gain majority, thus it is not bitcoin.”

Erik Voorhees on the Gemini Dollar

On September 10, 2018, the Winklevoss twins and U.S.-based regulated crypto exchange Gemini released the Gemini dollar (ticker symbol: GUSD) - a stablecoin, which, they say “combines the creditworthiness and price stability of the U.S. dollar with blockchain technology and the oversight of U.S. regulators.”

ShapeShift CEO Erik Voorhees believes the launch of GUSD will lead to the integration of global finance with crypto finance, which is essential for the long-term growth of the market.

People will poo poo this, but it's a big deal and an important step. Global finance is becoming further integrated with crypto finance. All that crypto needs in order to win is for this to continue. https://t.co/WKVsHKEqpR

— Erik Voorhees (@ErikVoorhees) September 10, 2018