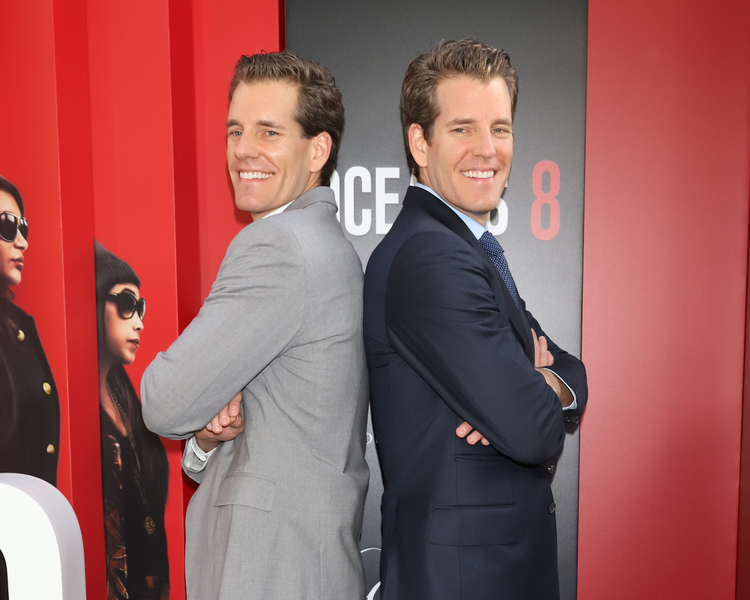

Winklevii - Harvard Graduates, Olympic Rowers, and Crypto Billionaires

Cameron and Tyler Winklevoss, aka Winklevii, the cryptocurrency millionaire twins best known for suing Mark Zuckerberg over the creation of Facebook. They have launched the Virtual Commodity Association that could become a prototype of the self-regulating association of cryptocurrency exchanges in the U.S.

The organization aims to develop common standards, which are now absent in the cryptocurrency industry, as well as increasing investor confidence in the market. The initial participants will include Bitstamp, Bittrex, bitFlyer USA, and the Gemini exchange run by the twins.

Who are the Winklevoss brothers?

Tyler and Cameron Winklevoss are a pair of American Olympic rowers and entrepreneurs. Born in New York on August 21, 1981, and raised in Greenwich, Connecticut, the twins studied at the prestigious Harvard University from 2000 to 2004, graduating with BA degrees in economics.

In 2004, the Winklevoss brothers rose to fame after they sued Facebook founder Mark Zuckerberg, claiming he stole their ConnectU idea to create the popular social network Facebook. In 2008 they were awarded $65 million to settle the lawsuit.

ConnectU (originally HarvardConnection) was a social networking website launched on May 21, 2004, that was founded by Harvard students Cameron Winklevoss, Tyler Winklevoss, and Divya Narendra in December 2002. Users could add people as friends, send them messages, and update their personal profiles to notify friends about themselves.

The Winklevii, as they are also known, were planning to appeal the ruling by a federal appeals court in San Francisco, but changed their minds.

The battle between the twins and Zuckerberg was dramatized in the 2010 film “The Social Network.”

The brothers competed in the men's pair rowing event at the 2008 Beijing Olympics.

In 2009, they began their MA of business study at the Saïd Business School at the University of Oxford and completed MBA degrees in 2010.

The pair famously invested $11 million into bitcoin in April 2013. At the time, each coin was worth just $120. Today, their investment is valued at well over $1 billion.

Gemini Exchange

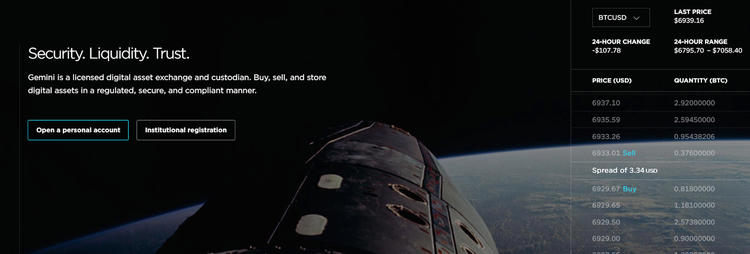

Tyler and Cameron Winklevoss announced their Gemini cryptocurrency exchange in January 2014 and the company went live on October 25th, 2015.

Based in New York, Gemini quickly became one of the most respected cryptocurrency exchanges. The licensed digital asset exchange that allows customers to buy, sell, and store digital assets is regulated by the New York State Department of Financial Services (NYSDFS).

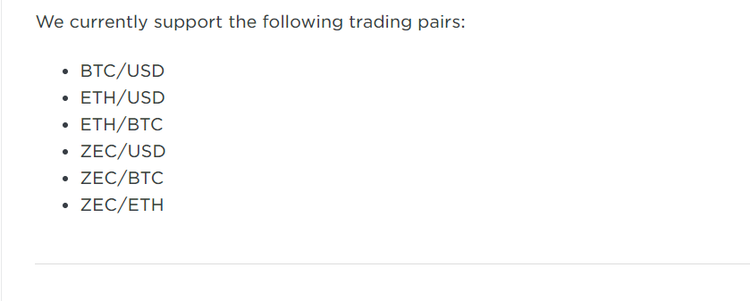

With a $32,145,675 daily trading volume, Gemini is currently ranked the 40th largest cryptocurrency exchange in the world. It lists bitcoin, ethereum, and Zcash.

Gemini accepts deposits made by ACH (automated clearing house) in the U.S., and wire transfers elsewhere. It also accepts deposits in bitcoin, ethereum, and Zcash. The Winklevoss twins say that their main goal in 2018 is to add bitcoin cash and litecoin.

All the payment methods are entirely free on the Gemini platform. However, wire transfers may be subject to fees from the bank that the money is sent from.

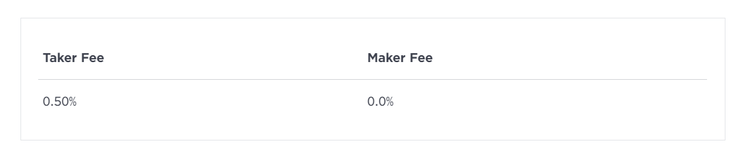

The fee rate for every trading pair is determined by the user’s total gross trading volume in notional USD across all of Gemini’s continuous order books, auction order books, and block trading over a 30 calendar day trailing window.

The fee rates for all block trades are fixed for all trading pairs.

As an additional security measure, only a small percentage of the bitcoin at Gemini is held online. Most of the crypto is held offline to minimize potential loss from hacks.

In April Reuters reported that Gemini was increasing oversight of its cryptocurrency trading using Nasdaq Inc’s market surveillance technology to detect manipulation and fraudulent trades.

In May 2018 Gemini announced a partnership with Caspian, a full-stack cryptocurrency trading and risk management platform for institutional and complex investors.

“Our new partnership with Gemini will help us to not only increase our user base but also provide sophisticated connectivity and interoperability across various cryptocurrency exchanges,” said Robert Dykes, CEO of Caspian.

Back in January 2018, Gemini announced the successful first settlement of bitcoin futures, which traded on the Cboe Futures Exchange under the ticker “XBT.”

Last month the Securities and Exchange Commission rejected a second attempt by Cameron and Tyler Winklevoss to list the first-ever cryptocurrency ETF on a regulated exchange.

Last year, the SEC disapproved an application for the "Winklevoss Bitcoin Trust" but in June, the group submitted a proposed rule change. Among other things, the agency said in a release that it did not support the brothers’ argument that bitcoin markets, including the Gemini Exchange, are "uniquely resistant to manipulation." It also highlighted issues of fraud and investor protection.

First Bitcoin Billionaires

In 2013, the twins told the New York Times that they owned more than $11 million worth of bitcoin, when the cryptocurrency was trading at $120 per coin. The brothers reportedly bought 1 percent of all Bitcoin that was in circulation at the time.

Cameron and Tyler became the first bitcoin billionaires, as the largest cryptocurrency hit above $11,000 in early December 2017, marking an increase of over 9,000 percent since the brothers made the investment.

Despite the huge plunge in the value of digital currencies this year, the Winklevoss brothers remain positive for mainstream crypto adoption.