What happened in the cryptocurrency market and to three main currencies — bitcoin, ethereum and XRP over the past weekend.

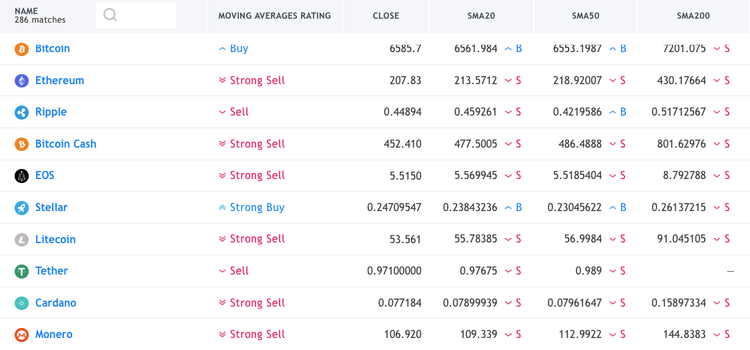

Top-10 cryptocurrencies by trend following as of October 22

On Friday and the weekend bitcoin adhered to a neutral scenario, ethereum and XRP turned out to be slightly stronger, however, bullish scenarios didn’t reach their basic goals.

Bitcoin

Bitcoin (Bitcoin) remains in the center of the high-volume area, the closest support lies near the $6,350 mark. The main scenarios have not changed since Friday.

Time-lapse: on October 22, 2017, bitcoin price continued to grow, stopping at $5,828.

Daily Scenario

BTC chart by TradingView

Today the neutral scenario provides further fluctuations near the control price of the area, which moved from $6,428 to $6,439.

Ethereum

Ethereum (ETH/USD) moved to the upper border of the current area, which indicates some strength on behalf of the buyers. The resistance is observed near the $206 level, the support is formed at the control price of $196. Over the weekend the most popular level was $203.7.

Time-lapse: on October 22, 2017, ethereum price decreased to $294.3.

Daily Scenario

ETH chart by TradingView

Today bulls may attack the maximum marks of Tuesday and Wednesday (together with the low-volume level of $207) and move into the interval of $206 - $213.

XRP

XRP (XRP/USD) found a logement in the $0,449 - 0,469 area. The logical continuation will be a test of its upper border.

Time-lapse: on October 22, 2017, XRP price fluctuated near $0.20.

Daily Scenario

XRP chart by TradingView

Today the primary goal can be the upper border of the current area ($0,469). The global goal is the maximum mark of October 8 ($0,496).

Aside from bitcoin, ethereum, and XRP there are several other interesting digital currencies or altcoins worth taking a closer look at. The losers and winners of the past 24 hours are: EDUCare with 102.77% growth and Nexty with 34.56% decrease. Keep an eye on cryptocurrencies, study them and use our quotes page to keep up to date.

Trading in the cryptocurrency market is associated with high risks and is not suitable for every investor. The above analysis should not be considered as a recommendation or a call to action. Each trader should assess the risks for themselves. Both the author and ihodl.com are not liable for the potential losses incurred.