All past week, a dozen top-end cryptocurrencies fell in price. XRP, which in mid-September showed an increase of more than 100%, has fallen by 15% since the start of October. Prices for the rest of top coins fluctuated in the region of 1-6%. Forming a flat around $200 billion market cap, the total market capitalization decreased by 8%.

The investment director of the Yale University Foundation with a capital of $29.4 billion, David Swensen last week invested in two cryptocurrency venture funds. He supported the crypto-fund Andreessen Horowitz and Paradigm, which was created by Coinbase co-founder Fred Ehrsam and former partner of Sequoia Capital, Matt Huang.

Earlier this week, a brokerage corporation with assets of $1.2 trillion. TD Ameritrade investedin the regulated stock exchange ErisX. The futures managing director explained that regardless of the fall in cryptocurrency prices compared to the beginning of this year, the demand for it, still remains. In 2019, they plan to launch futures and spot contracts for bitcoin (BTC), bitcoin cash (BCH), ethereum (ETH) and litecoin (LTC) on the platform, and in the future they will also add options.

This news could prompt new large-scale growth, says partner and investment analyst at the venture company Blockchain Capital Spencer Bogart. Bogart, as well as Mike Novogratz, believes that the market has reached the bottom.

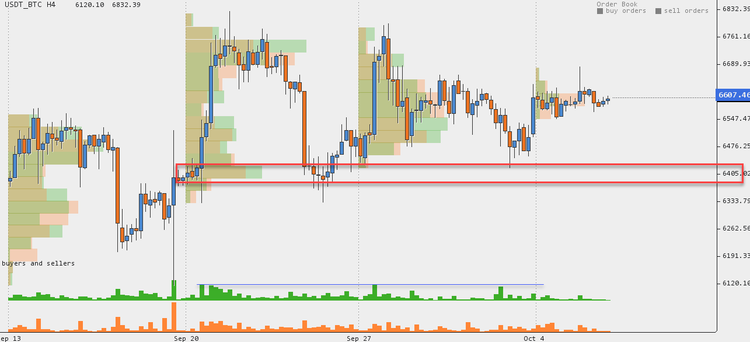

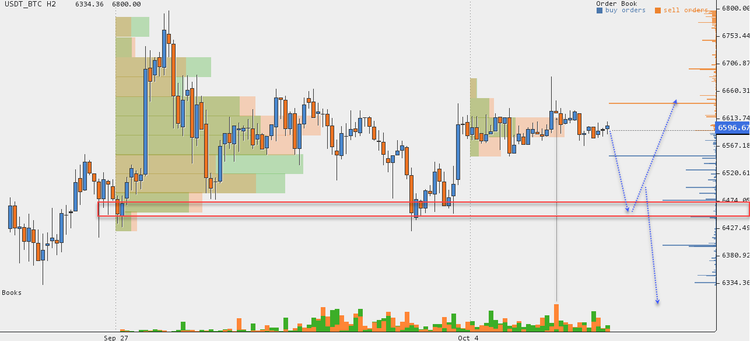

The emergence of a large offer in late September for bitcoin and other coins had a negative impact on prices. The rates of the top cryptocurrency corrected to key points. As expected, a false breakdown occurred downward on bitcoin and the price pushed off from the support of $6,400.

When approaching this mark, the volume of purchases continued to increase, but the main purchases were made at the end of September. Judging by the positive news last week, it can be assumed that buyers at the $6,400 level have placed their protective orders below $6,120.

The peculiarity of the flat is that it breaks the boundaries and thus the price returns. With an expanding flat, the breakout can be deep. Because of this, the position will close, but the price will return. In such situations, traders put up their protective orders at a much lower level. At such times, large short-term sellers have the opportunity to bring down the price to lower levels in region of $6,000, and after an upward rebound, sell it on for $6,400. Therefore, this could be one of the scenarios for next week.

At the peak of the previous growth, a large offer has reappeared, after which the price began to roll back. During all the short-term growth we have seen since the beginning of October, more supply has emerged than demand. If the bitcoin rate stays in the $6,500 area and breaks the peak of the short-term trend, then there will be a chance to grow above $7,000. Otherwise, the rate will again fall to $6,400, and possibly even lower, to the point where the choice for a direction for the medium-term movement will take place.

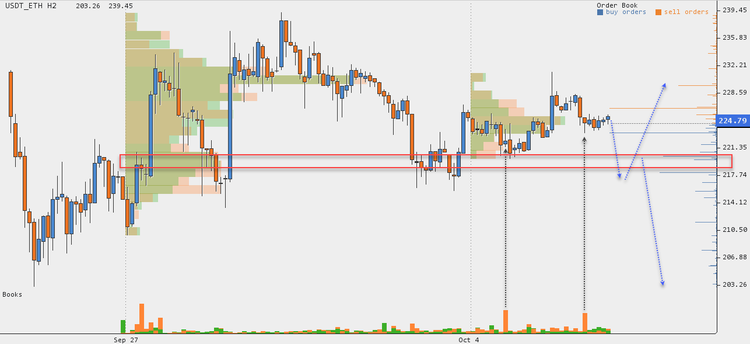

After the increase in the price of ethereum to $230, there were less willing to buy and the price dropped to the largest volume of buyers in the region of $210. The upward movement from September 25 cannot be called a trend. The rate of ETH confirmed this after September 28, when a sharp decline occurred.

This happened due to a breakthrough of the classic resistance level - a trend channel. The volume profile shows how the largest volume of purchases was formed after the breakthrough, and there were more sales. In order for us to start talking of the beginning of an upward trend, the rate must overcome the level of $230.

Given the price reaction to the previous increase in supply, the odds are once again in favor of a fall. After a rebound from the support of $210, significant volumes of supply appeared in the region of $220 - $230. If the advantage of sellers remains, then the price of ether will fall below $200. To confirm this scenario, a turnaround to $210 will be needed. If the rate fails to turn downwards, then the next upward rebound will occur.

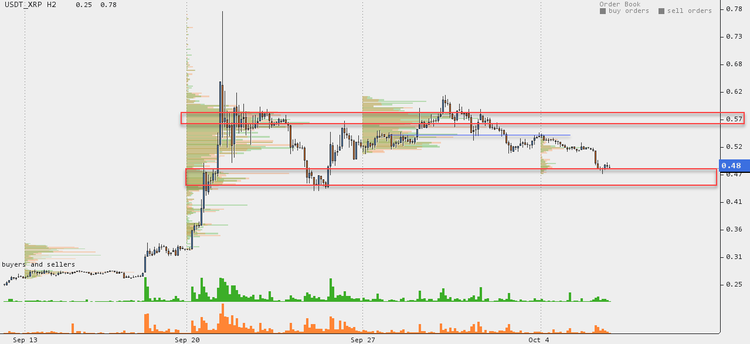

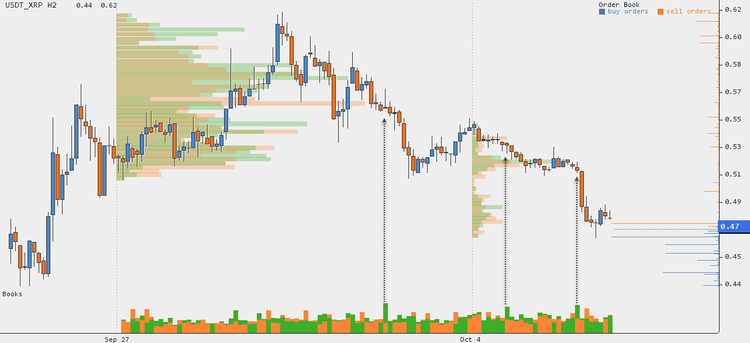

XRP formed a flat downward wave. The wave was confirmed after the cryptocurrency could not hold onto the support of $0.53.

A breakthrough of this mark means that support for an uptrend is not yet sufficient enough. From a technical point of view, with the growth since September 27, the rate broke the bottom of the third wave, which is also the upper boundary of the flat. Because of this, there was a downward rebound.

The probability of the next movement is so far in favor of growth.

After reaching the bottom of the flat in most cases, a rebound occurs. Confirmation of growth - the emergence of demand, which prevails over supply in the region of $0.5- $0.55. If the situation changes in favor of the sellers, then the growth will be no higher than within these levels.

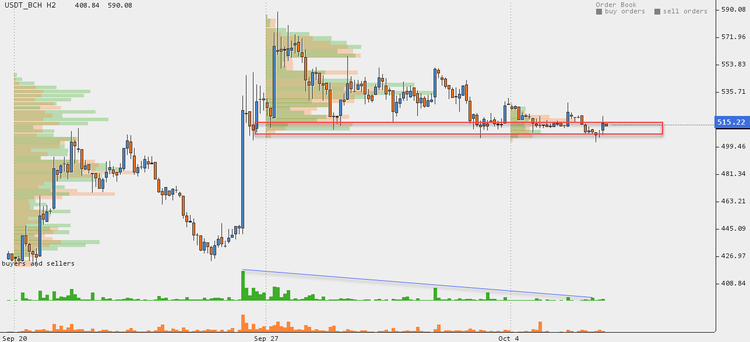

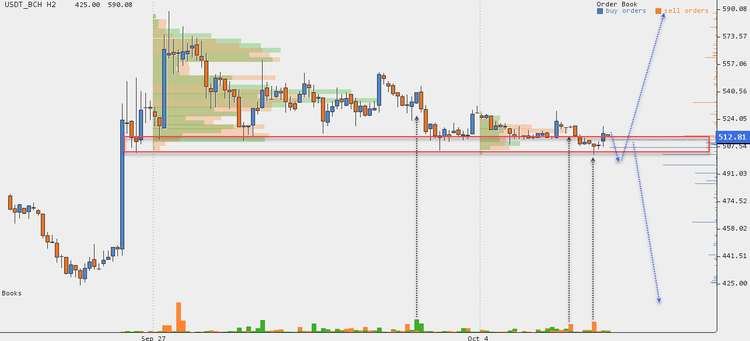

Last week bitcoin cash rebounded up from the support of $500 three times. The volume of purchases at this level are falling, which means the moment of truth is near.

The bulk of purchases which made up the upward movement from September 25 onwards is in the region of $530- $550. At the current level the fate of all potential growth is on the line, which began on September 19.

In the previous article it was determined that with at $500 a reversal a rising wave could be a wave of a flat and therefore the price would collapse below $400. If at the beginning of October the demand prevailed, then by the end of the first week the situation with BCH changed in favor of the sellers. The fall in the volume of purchases and the emergence of a significant amount for sale means one thing - a price reduction below $425. To confirm you need a new breakdown of $500 and consolidation below $512.

EOS, Stellar, Litecoin, Cardano and Monero also form a correction resembling a converging triangle. Usually, the first breakthrough of the border of such a triangle occurs with a false one, after which the price either moves in the opposite direction, or is fixed and a hike take place with fresh strength.

Trading in the cryptocurrency market is associated with high risks and is not suitable for every investor. The above analysis should not be considered as a recommendation or a call to action. Each trader should assess the risks for themselves. Both the author and ihodl.com are not liable for the potential losses incurred.