What happened in the cryptocurrency world over the past 24 hours.

On Tuesday the situation in the cryptocurrency market developed according to a bullish scenario but in fact, we witnessed quite an unusual dynamic. After the initial splash in prices, nothing happened - neither the pressure from seller’s nor an attack from the buyers.

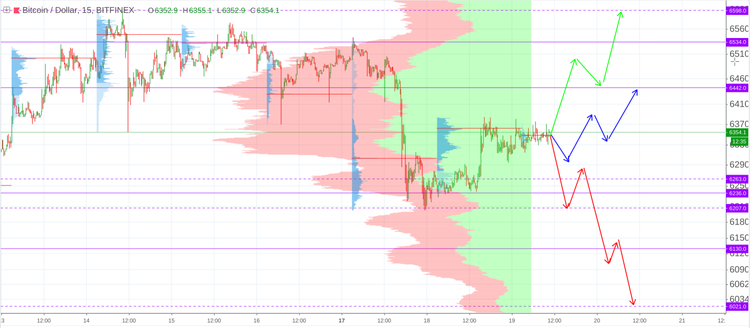

Bitcoin

Bitcoin (Bitcoin) is currently in the high-volume area of $6,207 - 6,598 and remains at an equilibrium, testing the borders of the area.

Time-lapse: on September 19, 2017, the bitcoin fixed at $3,960.

Daily Scenario

BTC chart by TradingView

Today bitcoin is likely to follow a neutral scenario, that proposes fluctuations in the $6,297 - 6,388 range with a possible drift towards $6,442 in the afternoon.

Ethereum

Ethereum (ETH/USD) has fulfilled the first goal of the bullish scenario - by returning to the $209 - 238 area and testing the open control price of Monday ($219,9) which was the level where the drop began.

Time-lapse: on September 19, 2017, ethereum was pumping and stopped at $285,67.

Daily Scenario

ETH chart by TradingView

Ethereum is gradually working out its local levels of low-volume area, forming one in a $186 - 238 range. This outcome suits both sellers and buyers. In the future this area can become a serious support or resistance depending on trend.

Dash

Dash (DASH/USD) remains within the borders of the triangle. It will be interesting to watch how it comes out of it.

Time-lapse: on September 19, 2017 dash slightly decreased and fixed on $326,72.

Daily Scenario

DASH chart by TradingView

Today the scenario proposes further consolidation in the current range ($183-196).

Aside from bitcoin, ethereum, and dash, there are several other interesting digital currencies worth taking a closer look at. The losers and winners of the past 24 hours are: Patron with 45,04% growth, and BitRent with 62,59% decrease. Keep an eye on cryptocurrencies, study them and use our quotes page to keep up to date.

Trading in the cryptocurrency market is associated with high risks and is not suitable for every investor. The above analysis should not be considered as a recommendation or a call to action. Each trader should assess the risks for themselves. Both the author and Insider.pro are not liable for the potential losses incurred.