What happened in the cryptocurrency world over the past weekend.

In general, on Friday and the weekend, market followed a neutral scenario (moderate bullish in case of bitcoin). All three cryptocurrencies tested the primary goals of the bullish scenarios, but further growth didn’t come. It should be noted that positive signs appeared in regards to many promising altcoins over the last week. They may indicate an early start of the medium-term bullish trend.

Bitcoin

The most noteworthy events of the previous three days were the test of control price of the high-volume area on Friday ($6,455) and the resistance attack at $6,800. On Saturday and Sunday bitcoin (Bitcoin) was mainly in the $6,646 - 6,800 area.

Daily Scenario

For bears, the primary goal is a harsh upward trend, formed over the last 4 days. There are two ways to break it:

- make a direct attack with a test of minimum mark of Sunday and a return to $6,455;

- for some time to "hang" in the current area within the framework of a neutral scenario ($6,246 - 6,800).

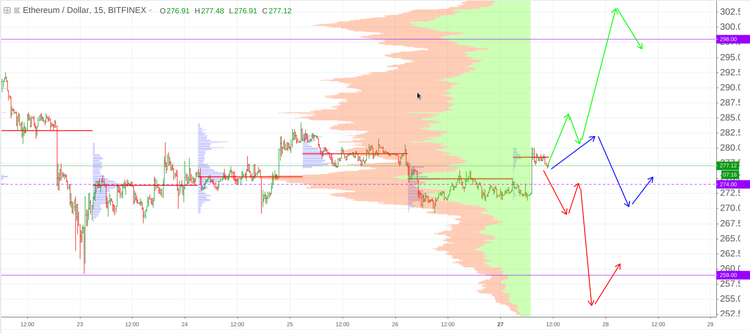

Ethereum

After the tests of the control price ($298 and $259) ethereum (ETH/USD) got caught between two high-volume areas. Over the past few days the cryptocurrency has worked through to the $274 level.

Daily Scenario

Today we can hope for a bullish scenario that provides a test of the $285 level and further movement to $298.

Dash

Over the weekend, dash (DASH/USD) was able to break the downtrend, which was mentioned on Friday. That’s a favorable situation for bulls.

Daily Scenario

Today buyers need to force a successful attack on $155 and gaining a foothold in the $155 - 162 range.

Aside from bitcoin, ethereum and dash, there are several other interesting digital currencies available from the 1,700 which are worth taking a look at. The losers and winners of the past 24 hours are: LeaCoin with 200,05% growth and CEEK VR with 27,76% decrease. Keep an eye on cryptocurrencies, study them and use our quotes page to keep up to date.

Trading in the cryptocurrency market is associated with high risks and is not suitable for every investor. The above analysis should not be considered as a recommendation or a call to action. Each trader should assess the risks for themselves. Both the author and Insider.pro are not liable for the potential losses incurred.