What happened with bitcoin, ethereum and dash rates over the past 24 hours.

Bitcoin

Bitcoin (Bitcoin) continues its growth. Ten days ago, $8,225 level seemed unrealistic, almost a dream. Yesterday bitcoin covered that level and almost didn’t stay there. Today the most famous cryptocurrency has launched an attack in the $8,600 direction - now this level is the main goal for bulls. Then it's possible to move on to $8,880.

Daily Scenarios

1. Bullish

Currently, the market is completely controlled by players of a higher temporal order, so it’s only logical to expect continuation of growth. Today, at least one more attack is likely towards the $8,600 direction, while we can witness some consolidation in the $8,225 area.

2. Neutral

Neutral scenario involves a consolidation in high-volume area ($8,120 – 8,430). The market deserves a short pause.

3. Bearish

Taking into account a weak market structure (bitcoin has pumped and the trading volume in the $7,800 – 8,100 area was very small), the nearest probable support is in the $7,930 area. If buyers are not activated here, it’s possible to see a reduction to $7,700.

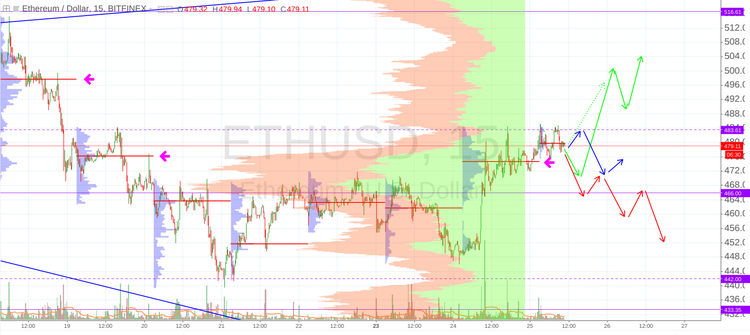

Ethereum

Over the past 24 hours, ethereum (ETH/USD) has tested the border of the high-volume area ($483) three times. Its breakthrough seems inevitable. The question is whether the cryptocurrency will try to pass the resistance or will save the energy in the $474 area. The second option seems stronger and preferable.

Daily Scenarios

1. Bullish

The main goal for buyers in this scenario is $497 - opened control price of the past Wednesday (July 18). Then it was the level where the fall began.

2. Neutral

Neutral scenario proposes fluctuations within $466 – 483 area.

3. Bearish

Bearish scenario provides a decrease into the $466 area with the subsequent test in the $452 direction.

Dash

Whole previous day dash (DASH/USD) spent in the $247 – 256 area. This behavior is somewhat troubling because of the rapid growth of bitcoin. Today’s scenarios haven’t changed much.

Daily Scenarios

1. Bullish

The main task for buyers is an attack at $260. If it’s successful, a test of $267 will be possible.

2. Neutral

Neutral scenario foresees a further consolidation in the $247 – 256 range.

3. Bearish

Bearish scenario remains the same: a decrease to $226 with the subsequent test of the upper border of the wedge ($220).

Trading in the cryptocurrency market is associated with high risks and is not suitable for every investor. The above analysis should not be considered as a recommendation or a call to action. Each trader should assess the risks for themselves. Both the author and Insider.pro are not liable for the potential losses incurred.