What happened with bitcoin, ethereum and dash rates over the past weekend.

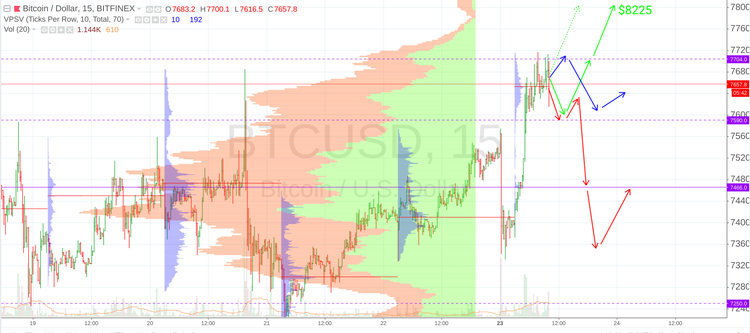

Bitcoin

Most of last week bitcoin (Bitcoin) stayed in the high-volume area ($7,250 – 7,590). This is a potentially favorable sign, as it points at buyers’ demand on the advanced levels. This morning the cryptocurrency has overcome the $7,590 resistance and has come close to $7,704. Above that level the low-volume area ($7,700 – 7,900) is situated, which bitcoin may pass rather quickly in the case of a breakthrough of the resistance. The main target is $ 8,225.

Daily Scenarios

1. Bullish

As the price dynamics show, today we can face an attack on $7,704. At the same time, it’s difficult to guess, whether the cryptocurrency can pass the resistance right now, or we can expect a preliminary decline to $7,590. The probability of the first option is higher, but the second one seems more reliable.

2. Neutral

Neutral scenario shows a consolidation in the current range after the resistance test of $7,704.

3. Bearish

In the current situation of the bearish scenario, it provides a decline into the high-volume area ($7,466) and fluctuations within its local borders ($7,350 – $7,515).

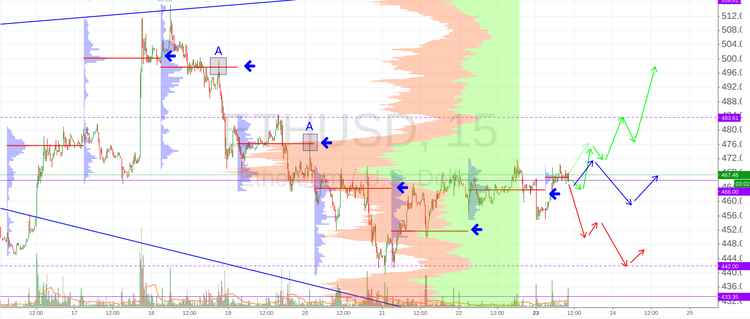

Ethereum

Ethereum (ETH/USD) lost all of its last week's growth, but at the same time the cryptocurrency fundamentally worked through all the levels with a weak market structure and a small trading volume. Buyers became more active near the $442 level and returned ethereum to $466. It may serve as an excellent foundation for further growth.

Daily Scenarios

1. Bullish

Worth remembering that on July 17-21 the benchmark price was constantly decreasing, and on Sunday the situation changed. Throughout the previous week. sellers had dominated in the market and only on Sunday buyers were able to regain control. The main goal of the bullish scenario is $483. It will be interesting to observe the behavior of prices at $476 and $497 levels - as in the past these were the points where sellers became active.

2. Neutral

Neutral scenario seems obvious: further consolidation in the high-volume area ($459 – 470).

3. Bearish

The main targets for sellers are $452 (from this level the repurchase began on July 21) and $442 - the lower border of the high-volume area.

Dash

On Friday, dash (DASH/USD) was demonstrated an interesting dynamic, a breakthrough of the resistance hasn’t lead to the growth of the buyers’ interest (the first alarming sign). The subsequent splash, that was coinciding with an attack at the rest of the market, was predictably followed by the rapid decline. If today the situation develops in accordance to a bearish scenario, we can witness a test of the upper border of the wedge.

Daily Scenarios

1. Bullish

The main task for buyers remains a breakthrough of the resistance at $272. Next step is a test of the $280 – 284 area - on Friday it was the point where sellers became more active.

2. Neutral

Neutral scenario proposes a consolidation in the $238 – 249 area after the $255 test.

3. Bearish

Bearish scenario provides a decrease to $226 with a subsequent test of the upper border of the wedge ($220).

Trading in the cryptocurrency market is associated with high risks and is not suitable for every investor. The above analysis should not be considered as a recommendation or a call to action. Each trader should assess the risks for themselves. Both the author and Insider.pro are not liable for the potential losses incurred.

By Yana Sher