What happened with bitcoin, ethereum and dash rates over the past 24 hours.

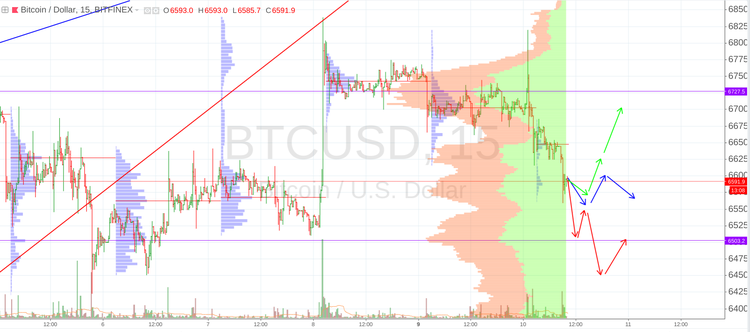

Bitcoin

Bitcoin (Bitcoin) remains in the high-volume area and in the future, we can see the development of a bullish trend as in this area, sellers have become active. Mass closing of short positions and a supply reduction will accelerate the growth after achieving $6,800 a mark.

Daily Scenarios

1. Bullish

Buyers expect to return bitcoin to a high-volume area ($6,700) and possibly test the short price of Friday/Saturday ($6,565).

2. Neutral

Neutral scenario proposes fluctuations in the current high-volume area ($6,548 – 6,606).

3. Bearish

Bears can test Friday's minimum mark and wait for a return to the $6,504 level.

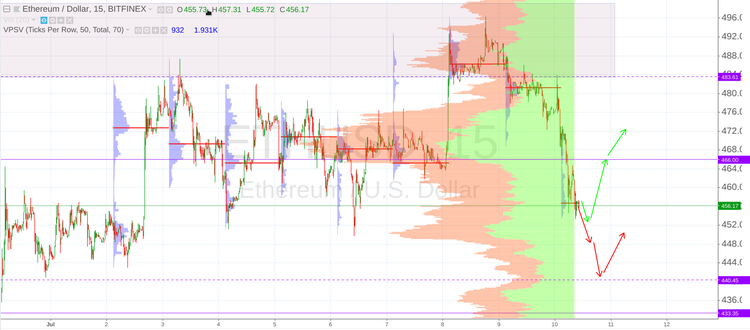

Ethereum

Ethereum (ETH/USD) is mounting an attack on the minimum mark of last week. Usually, active growth starts with $452 level.

Daily Scenarios

1. Bullish

Bullish scenario provides a test of Friday's minimum mark at level of $452 and then a return to the high-volume area ($464 – 472).

2. Neutral

Neutral scenario in the current situation is very unlikely. Ethereum will return to $466 or fall into the $445 – 453 area.

3. Bearish

Bears may test the $452 level and hope for the decline to $440.

Dash

Dash (DASH/USD) has escaped the borders of the triangle and is currently moving towards the minimum marks of June.

Daily Scenarios

1. Bullish

Bullish scenario suggests focusing on the current area and a subsequent attack on $236.

2. Neutral

Neutral scenario in the current situation is difficult to imagine.

3. Bearish

Bearish scenario will depend on the behavior of buyers at the minimum mark ($216). We have two options: First option will show a consolidation and the subsequent return to the $224 – 228 area. The second one may show a breakthrough in the support level and a decline to $210.

Trading in the cryptocurrency market is associated with high risks and is not suitable for every investor. The above analysis should not be considered as a recommendation or a call to action. Each trader should assess the risks for themselves. Both the author and Insider.pro are not liable for the potential losses incurred.

By Yana Sher