What happened with bitcoin, ethereum and dash rates over the past 24 hours.

Bitcoin

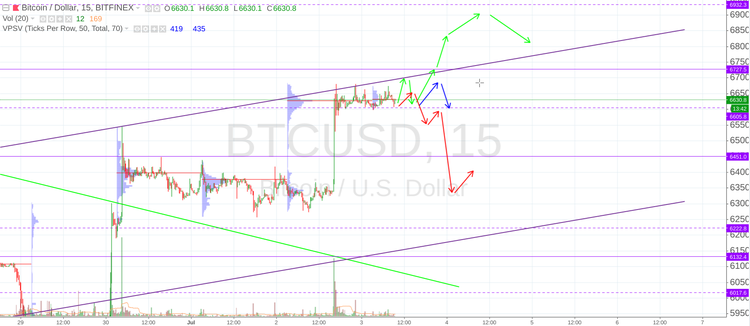

Bitcoin (Bitcoin) technically remains in the ascending channel, the upper boundary of which turned into resistance yesterday. The $6,605 level was set as a support. At the moment bitcoin has two core scenarios. The first supposes a return to the high-volume area (the center is $6,727), the second one is a rollback to the $6,270 - 6420 range.

Daily Scenarios

1. Bullish

Bullish scenario assumes a drift towards the control price, an attack on the maximum mark of June 18-19 and a test of the upper boundary of high-volume area ($6,900).

2. Neutral

Neutral scenario proposes fluctuations in the current range (a rehearsal of consolidation dynamics is most likely).

3. Bearish

Bears can wait for a decrease to $6,450 level and a test of Monday’s minimum mark.

Ethereum

Ethereum (ETH/USD) looks to be in a stronger position than bitcoin. this morning ethereum has tested the $483 resistance mark and is now consolidating a little bit lower.

Daily Scenarios

1. Bullish

The main task for ethereum in this scenario is the movement to a high-volume area with a control price ($516). It is necessary to overcome the $483 resistance and fix in the $483 - 507 range.

2. Neutral

The unsuccessful attempt to enter the high-volume area can lead to the subsequent rollback to the $470-480 range.

3. Bearish

Bears expect a decrease to the control price ($459) and a consolidation in the $444 - 457 area.

Dash

Yesterday dash (DASH/USD) fulfilled its main goal within the bullish scenario (rising to $258). The breakthrough of the resistance at the $246 level led to the expected buyers’ activity. Next goal is the upper boundary of the channel ($270).

Daily Scenarios

1. Bullish

Bulls are eager for an attack on the upper boundary of the channel that will be followed by a consolidation.

2. Neutral

It seems to be fluctuating within the $247 – 257 range.

3. Bearish

It’s possible to wait for a breakthrough of the $247 support and a decline to $236.

The trade in the cryptocurrency market is associated with high risks and is not suitable for every investor. The above analysis should not be considered as a recommendation or a call to action. Each trader should assess the risks for themselves. Both the author and Insider.pro are not liable for the potential losses incurred.

By Yana Sher