All the necessary matters to know about receipts, electronic payment systems and exchange e-services.

Every cryptocurrency owner once faces a need to sell his coins and withdraw the money. Simple and convenient cash-out is even more important for the participants of cryptocurrency industry, as usually they receive wages or other rewards in crypto. But despite the source, everyone cares about one question: how to cash out the crypto easily, quickly, safely and at a reasonable price?

Despite the fact that the first crypto exchange began to work in 2010, and a well-known exchange platform localbitcoins.com appeared in 2012, the problem of rapid fund withdrawal is still relevant. How so? There are several reasons.

1. Majority of cryptocurrency exchanges don’t work with fiat currencies

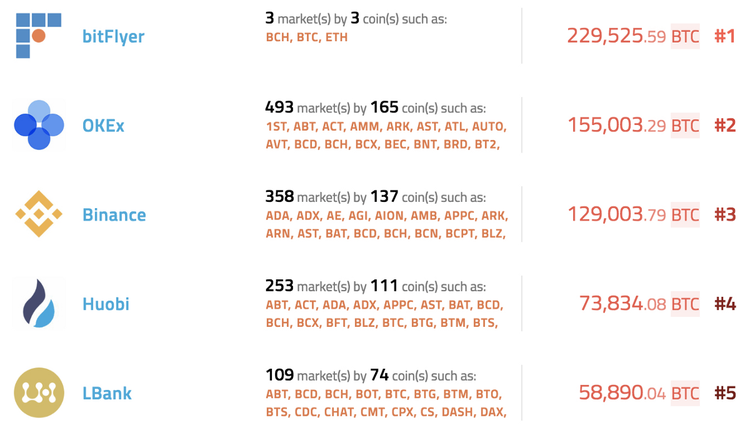

It seems insane, but it’s a fact. Four out of five largest cryptocurrency exchanges (by bitcoin trading volumes) don’t trade in pairs with US dollar, yen or euro. Only one of them - Bitflyer – allows to buy bitcoin for yen:

If we check the list of the biggest cryptocurrency exchanges, we will find only one cryptocurrency exchange, that works with world currencies (US dollar, euro, pound, yen) - Bitfinex. Making it the only one from the ten largest cryptocurrency exchanges in the world to work with the U.S. dollar.

Surely, it’s possible to find such platforms as Kraken, Bitstamp, GDAX. There you can find fiat couples, but there users come up against one severe difficulty, which will be discussed later on.

2. Bank payments from cryptocurrency exchanges can be a serious problem

Usually the largest cryptocurrency exchanges send money within a bank payment. That is why a bank should allow incoming payments from cryptocurrency exchanges. Many credit organizations consider such payments as undesirable in terms of requirements for anti-money laundering.

That means, that for receiving money, an investor must first of all find a bank, then wait for the transfer to be completed (usually it takes up to 3 - 5 days) and pay all outstanding taxes. Will a user become involved in such a complicated process to cash out a couple of hundred U.S. dollars for everyday expenses? Most likely not.

3. What about Localbitcoins and other cryptocurrency exchanges?

Unfortunately, all the services can’t be called either fast or flexible. And here's why:

- Long waits (the deal takes at least an hour);

- The way of payment is often inconvenient: a gift cards or a bank payment;

- The seller is forced to take a lead from the buyers and to agree their price (that is often lower than at a cryptocurrency exchange), or to set its own price and wait for the buyers.

Of course, localbitcoins platform has already become a legend, but it can’t be called quick or convenient.

What to Do?

The solution of a quick cash-out problem was found quite unexpectedly. It’s a synergy of claiming rights for the account balance and traditional e-money. Everything seems too complicated at first sight but in fact it is not.

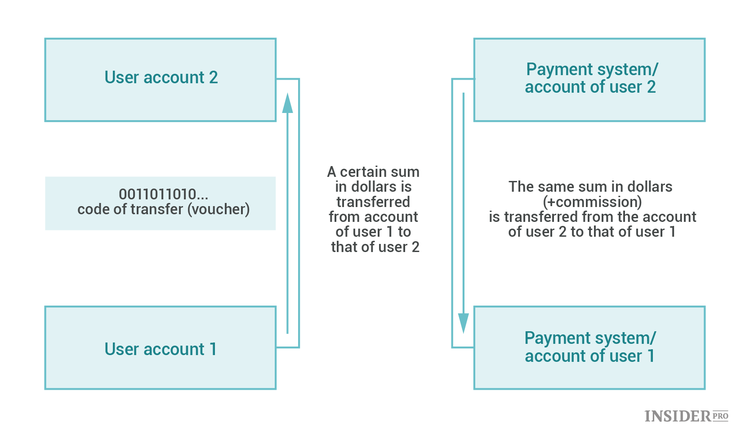

Imagine that a certain exchange supports the cryptocurrency sale for U.S. dollars and at the same time allows the account holder to transfer money to another account on the same exchange. The money recipient can return the same amount to the sender, but in the usual way. The similar transaction can be held by issuing a unique code (or receipt) that makes the transfer under the activation. Here is the scheme:

But who will be interested in buying the U.S. dollars that are stored in a cryptocurrency exchange? In fact, there are lots of claimants, either private investors wishing to buy a cryptocurrency, exchanges working with various electronic money services, large banks, cryptocurrencies and even gift cards. They can buy quite a substantial amount of U.S. dollars for further cryptocurrency investment or to sell on to customers who want to open an account on the cryptocurrencies exchange. So, the claimants make direct link between those who wants to cash out their cryptocurrencies and other that are entering the market.

The transaction part of the deal can easy carry out bypassing the dollar stage – it’s enough to transfer bitcoin or other cryptocurrency to another account. But is there an easy and fast way to transfer ordinary money? Yes – by using electronic payment systems or intra-bank payment.

Why electronic payment systems are easy and convenient?

The long-term experience shows that electronic payment systems are the best choice when the transferred amounts do not exceeded $10,000. At the same time money doesn’t leave the system, the operation takes quite a bit of time and looks like a usual transfer from one account to another.

The most popular and probably the best electronic payment services are Payeer, Advcash, Neteller and some local platforms. An undeniable advantage of such services is the ability to issue a card, which is tied to the account. As a result, money can be spent immediately after they drop into the account.

How to find an appropriate cryptocurrencies exchange?

First of all, it’s necessary to choose the exchange. The code (receipt) system is supported by EXMO, WEX, LiveCoin, Btc-Alpha and other.

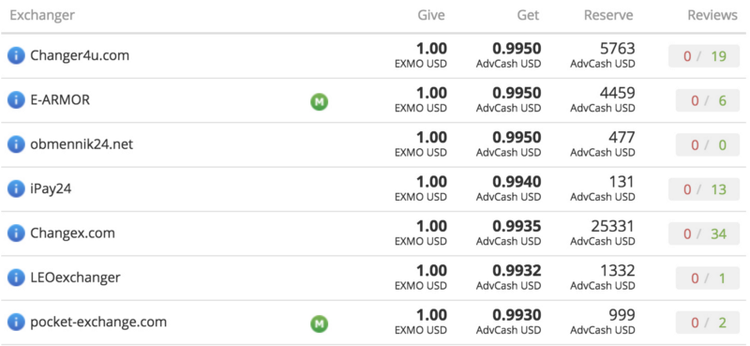

However, it’s not sufficient to have the technical ability to issue a code tied to the account for the successful cash-out. After the code is created, the final stage begins - searching for an exchange e-service with the ability to receive payments in a comfortable mode. It can be implemented by different exchange integrators, such as Okchanger or Bestchange. These services provide lists of exchanges that offer such service, for example:

After choosing the appropriate option, it’s time to start issuing the code and exchanging it into fiat money in the appropriate electronic payment system or bank. Usually the whole operation takes a few minutes.

And the End Result Is?

There is an excellent way to cash out cryptocurrencies quickly and safely by using receipts, electronic payment systems and exchange e-services. Customers who want to cash out their cryptocurrencies will contact investors entering the market.