What happened with bitcoin, ethereum and dash rates over the past 24 hours.

Bitcoin

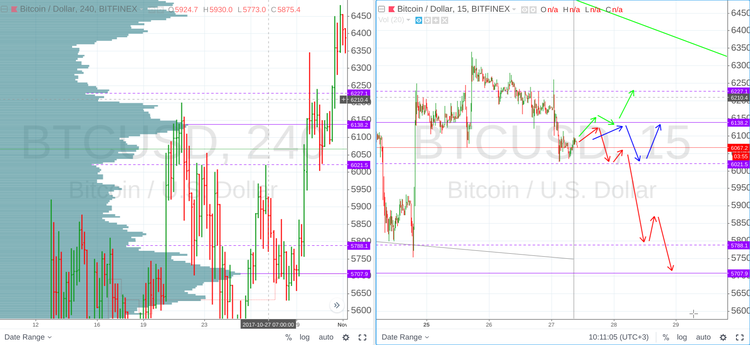

Bitcoin (Bitcoin) remains in the $6,020 – 6,220 area, as the market remains in equilibrium. Yesterday bitcoin has tested both borders, and is now gradually growing. Further dynamics will depend on the return to the $6,138 level. If bitcoin can fix on this level, growth is likely to continue. If the market participants reject the level, we are likely to see the fall to up to $5,788 – 5,708.

Daily Scenarios

1. Bullish

Bulls are hoping to see a return to the level of maximum volume ($6,138), and a test of the upper border at $6,227.

2. Neutral

It’s rather possible to see a consolidation in the $6,020 – 6,138 range.

3. Bearish

Bears can expect a test of $6,138, a rollback to $6,021 and a further decline to the $5,708 – 5,650 range.

Ethereum

Yesterday ethereum (ETH/USD) was cheaper than expected and has made it out of the high-volume area. The morning attempt to enter the lower $403 - 425 area has failed. The most likely scenario for today is a bearish scenario with a decline to $415 - 417.

Daily Scenarios

1. Bullish

We may fix a return at the $460 level, which is the most popular level over the last seven months.

2. Neutral

Neutral scenario is very unlikely today.

3. Bearish

Bears are waiting for growth to the $440 level, as seller’s activate a decrease to $417 is likely to occur.

Dash

Yesterday dash (DASH/USD) tested the local minimum mark in full accordance with the bearish scenario. Currently, the prices are close to the all important support level. If its broken, dash may fall to $170 – 180 in the future.

Daily Scenarios

1. Bullish

We can predict a growth to $234, some consolidation and then a return to the $238 - 242 area.

2. Neutral

Neutral scenario is unlikely in the current situation. The price may hove in the $226 - 232 area for some time.

3. Bearish

Beers could meet a break of the support line with a subsequent drop to $210.

The trade in the cryptocurrency market is associated with high risks and is not suitable for every investor. The above analysis should not be considered as a recommendation or a call to action. Each trader should assess the risks for themselves. Both the author and Insider.pro are not liable for the potential losses incurred.

By Yana Sher