Technical market analysis from cryptobroker AMarkets, Insider.pro partner

Bitcoin

Over the past two days Bitcoin's (Bitcoin) mood has changed again. Buyers didn’t succeed inholding the peg over $8500 although the techniques suggested the opposite. By 11:00 Moscow time, BTC/USD continued to decline, the peg of %8000 fell and, according to the growing volumes of sales, the corrective dynamics will survive.

The technical signs are on the bear side. Bitcoin rate dipped under the fast and long sliding averages, the alligator lines are going down, signaling the presence of bearish impulse, and MACD is below the zero mark.

It is important to note that the last hour candlestick managed to unload the oversold, shutting buyers from the hope for recovery. On this basis we suggest to keep the long position that was opened at the peg of $8000. Stop-loss is set at the level of $7750. In case of its attainment we will look closely at the sales target of $6000.

Dash

Dash (DASH/USD) is decreasing after bitcoin. The current technical picture clearly indicates the trend changes. As far as the initiative has completely moved to the sellers holding long positions, which were opened earlier, no longer make sense. It is time to take a closer look at the sales.

DSH/USD is just above the peg of $350. On May 12, it was the milestone that stopped the sellers, followed by a growth above $400. Considering the technical picture, meaning the price under EMA200 as well as the negative MACD, the price range along the lower Bollinger band is an advanced sign of deeper correction. In this context we recommend selling from the level of $348 in order to reduce Dash under the peg of $300.

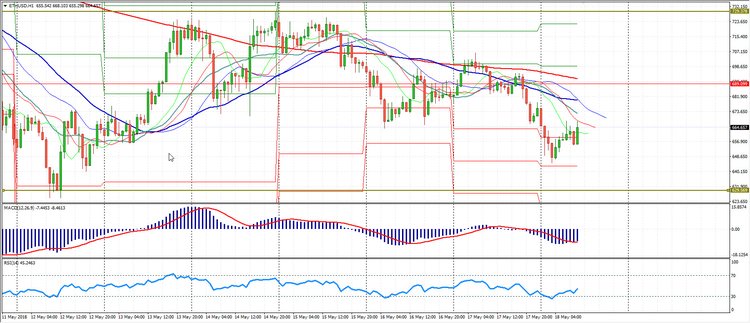

Ethereum

Ethereum (ETH/USD) was not an exception too. For third day in a row ETH/USD develops the descending dynamics, which has already led the pair at the level about $660. The last defensive point is the peg of $630, before the Ethereum will be able to aim to the level of $500. We place stop-losses of the previous long positions just below this mark. We will close at once in case of negative scenario.

The technical picture is entirely on the sellers’ side, as in case of Dash and bitcoin. If the rate will manage to break under 600$, we will try to participate in future decline.